Wealth Building

Modern Wealth Adds $570M AUM With Two Recent Offerings

Modern Wealth Management, a registered investment advisory backed by private equity launched last year of former United Capital executives, has acquired Philadelphia-based Wealth Management Solutions and Reston, Va.-based Autumn Wind Asset Management, bringing the firm's assets to more than $3.7 billion. Wealth Management Solutions, which has more than $400 million in AUM and 350 clients,…

Read MorePower of Representation | Asset management

I recently began my tenure as chief of operations with the Financial Alliance for Racial Equality (FARE), and for the first time in my career, I feel that my experience, talent, and passion are fully aligned with the organization I serve. FARE has been operating as a non-profit organization since September 2020 with a mission…

Read MoreAI Assistant Jump Wins Best in Show in WealthStack Demos

WealthStack, the wealthtech pillar of Wealth Management EDGE, held technology demonstrations during its annual conference this week at the Diplomat Beach Resort in Hollywood Beach, Fla. After reviewing the 11 contestants, the judges gave Best in Show Award THE Jump, an AI assistant for advisors that records customer conversations and produces to-do lists, notes and…

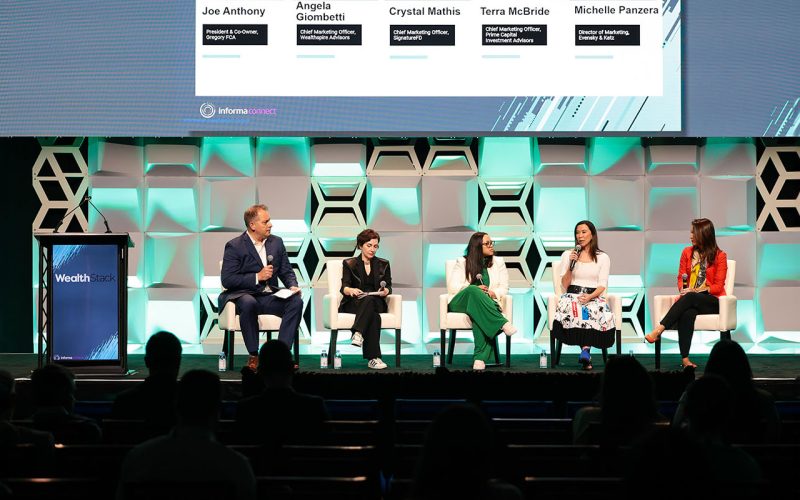

Read MoreWealthStack: Marketing is not a sale, it's an investment

Firms seeking organic growth must understand that marketing is not sales. Instead, it's a long-term investment that should be tracked by advisors, said Crystal Mathis, chief marketing officer at SignatureFD. “You have to know you're in it for the long haul,” she said. “A lot of people fall into the trap of 'I'm going to…

Read MoreIvan Boesky, convicted of insider trading in the 1980s, dies at 87

(Bloomberg) — Ivan Boesky, who rose to fame and fortune as a top Wall Street arbitrageur in the 1980s only to be exposed as a fraud in the era-defining insider trading scandal, has died. He was 87 years old. The New York Times reported his death, citing his daughter, Marianne Boesky. No details were immediately…

Read MoreCrypto firm Grayscale turns to Wall Street alum for new CEO

(Bloomberg) — Michael Sonnenshein is stepping down as chief executive of Grayscale Investments after a decade at the cryptocurrency asset manager and will be replaced later this year by Peter Mintzberg. Mintzberg, currently global head of strategy for asset and wealth management at Goldman Sachs Asset Management, will become the new CEO on August 15,…

Read MoreEditor's note: June 2024

Editor-in-Chief Susan R. Lipp weighs in on the contents of this month's issue. Source link

Read MoreOn the cover: June 2024

Guy Bardone's Terraces and Mer- Chora, Patmos sold for $2,432 at the Doyle At Home auction on April 24, 2024, in New York City. A French painter, Bardone was known primarily for his bold and colorful palette, use of light and sense of movement. His best known works depict landscapes and still lifes, painted using…

Read MoreTax law update: June 2024

• The final regulations set out rules for applying for an extension of time for certain generation transfer tax (GST) elections.— Section 2642(g)(1) of the Internal Revenue Code directs the Treasury to apply regulations to provide extensions of time when a taxpayer fails to make a timely election for: • share the GST tax exemption…

Read More