Google is the most popular search engine in the world, but its dominance over search ad revenue — and the vernacular of Gen Z — is waning.

According to one Wall Street Journal reportGoogle's share of 88.8 billion dollars The US search advertising market is expected to fall to its lowest point in more than a decade as a diverse group of competitors such as Amazon, Perplexity AI and TikTok offer alternative search experiences.

Consumers are conducting product searches through Amazon and social media searches through TikTok, with targeted advertising generating revenue for each business along the way. Perplexity is expected to inject AI search results with ads later this month.

Those rival bids will push Google's US search ad market share below 50% next year and bring Amazon's share down to about 25%, according to the WSJ.

Related: Google's AI overview has changed since its debut, and these websites have benefited the most

Additionally, Bernstein Research shows that Gen Z is barely using the term Google as a verb. New users are “searching” through social media, Amazon and ChatGPT; they are not “Googling”, writes Bernstein analyst Mark Shmulik in a September note.

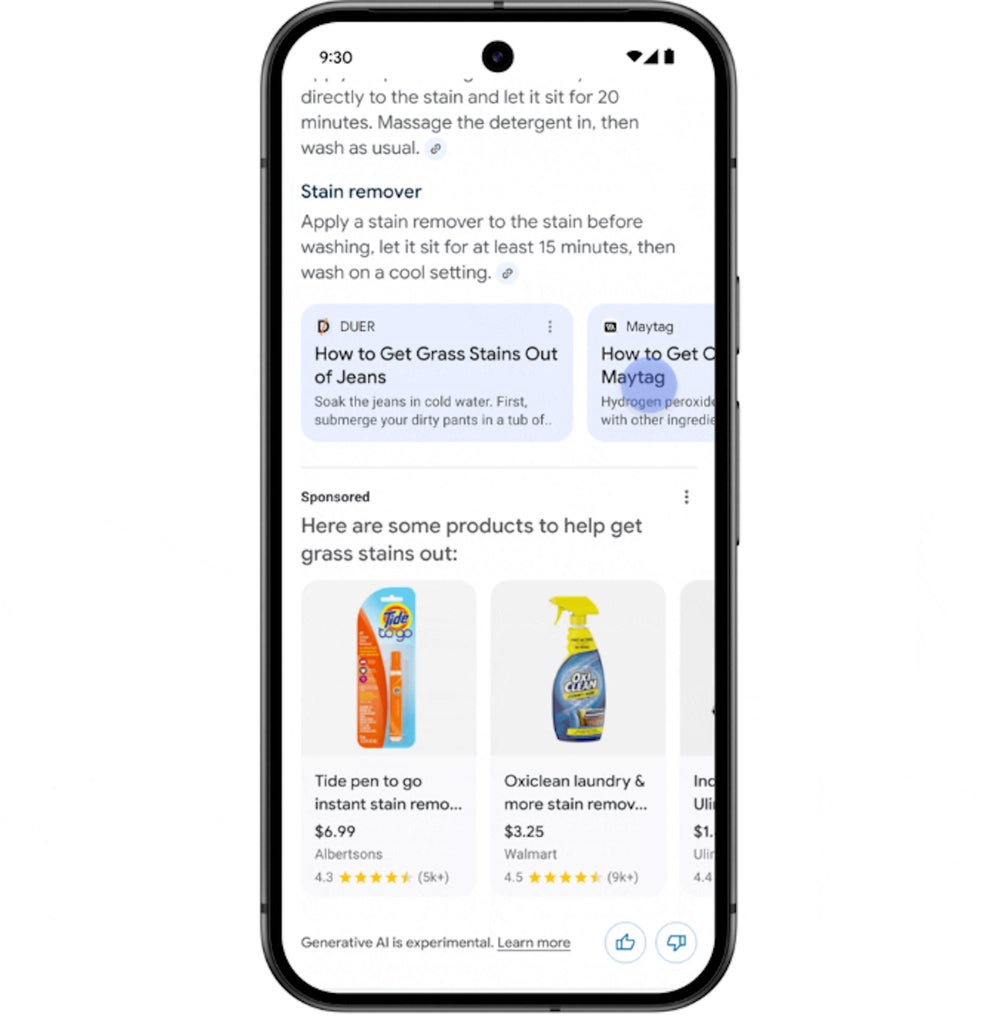

As of last week, Google's AI Briefings now display ads with relevant products under a “sponsored” banner. According to a Google spokesperson, ads will only appear under relevant searches.

Example of ads in Google AI summaries. Credit: Google

Even with AI rivals like ChatGPT, Google's numbers remain strong. Hers share of the overall search market at least 90% left so far. Bing, Yahoo and other search engines have less than 4% of the market each.

Google ad revenue also increased from 2022 to 2023, increasing from $224.47 billion to $237.86 billion.