Federal Reserve announced on Wednesday that it was cutting the federal funds rate by half a percentage point (0.5%) or 50 basis points, its first rate cut in over four years.

The previous rate range set by the Fed was 5.25% to 5.5%. higher in more than two decades. Now the range is between 4.75% and 5%.

The announcement followed a meeting of the Federal Open Market Committee, one of eight scheduled meetings throughout the year. Two more meetings are scheduled for 2024, in November and December, where the Fed could cut rates further.

“The Committee has gained greater confidence that inflation is moving steadily toward 2 percent and judges that the risks to achieving its employment and inflation objectives are roughly balanced,” an FOMC. press release stated. “In considering additional adjustments to the target range for the federal funds rate, the Committee will carefully evaluate incoming data, the evolving outlook, and the balance of risks.”

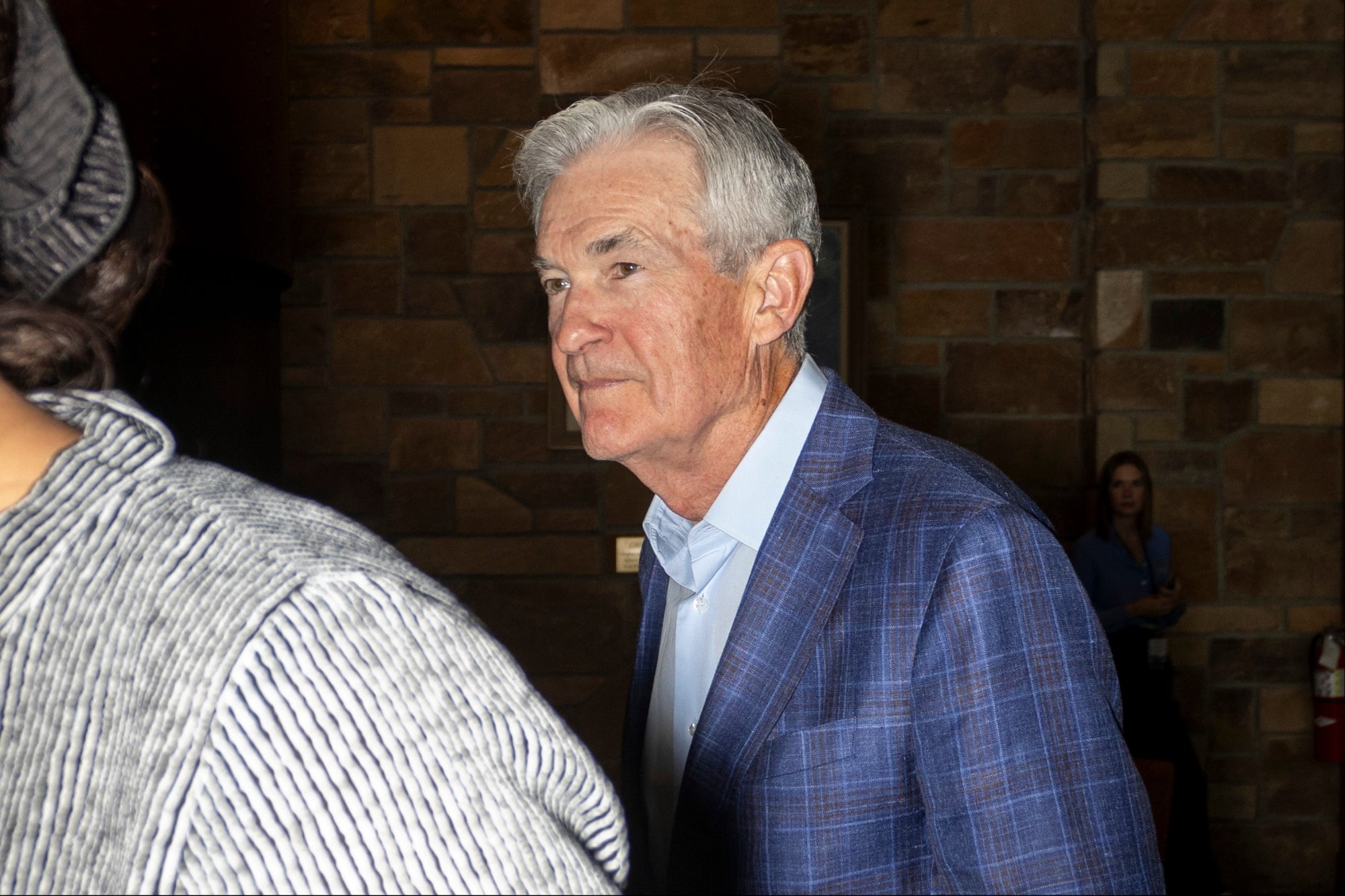

Federal Reserve Chairman Jerome Powell. Photo: Natalie Behring/Bloomberg via Getty Images

Federal Reserve Chairman Jerome Powell. Photo: Natalie Behring/Bloomberg via Getty Images

economists ESTIMATED the movement. EY chief economist Gregory Daco told Entrepreneur Last month the question was not whether the Fed would ease the federal funds rate in September, but by how much.

He reiterated a prediction that EY senior economist Lydia Boussour told Entrepreneur — that there would be three rate cutseach of at least 25 basis points or 0.25%, in September, November and December.

Related: CPI report: Inflation hits 3-year low, analysts predict Fed will cut rates next month

In one speech in August in Jackson Hole, WyomingFederal Reserve Chairman Jerome Powell, too predicted the cut saying “it's time for policy to adjust” to a cooling job market.

“The Fed has fallen behind the curve, but Fed Chairman Powell is playing catch-up,” Daco said.

How does the Fed's decision affect you?

The Fed adjusts the federal funds rate, or the borrowing rate that banks charge each other, in response to inflation and unemployment across the country. of AIMING is keeping prices stable and responding to the labor market.

Related: August Jobs Report Missed Expectations – Here's What It Means for Interest Rates

The federal funds rate flows into the borrowing costs consumers pay for credit cards, personal loans and cars. According to Bankraterate adjustments usually occur within one to two billing cycles for variable interest rate loans.

While mortgages are only partially affected by cuttingthe two tend to fall in line together. On Wednesday, rates fell to a lowest in two years of 6.15%. It is expected, based on the state of the economy and treasury yields, than mortgage rates will continue to fall.

Banks choose individually how to respond to rate cuts and increases.

The federal rate also affects purchasing power, labor markets, and the stock market.