bear Prices hit a new high in Asian trade on Monday, largely based on growing investor confidence that the Federal Reserve will implement a significant interest rate cut later this week, reports Investing.com.

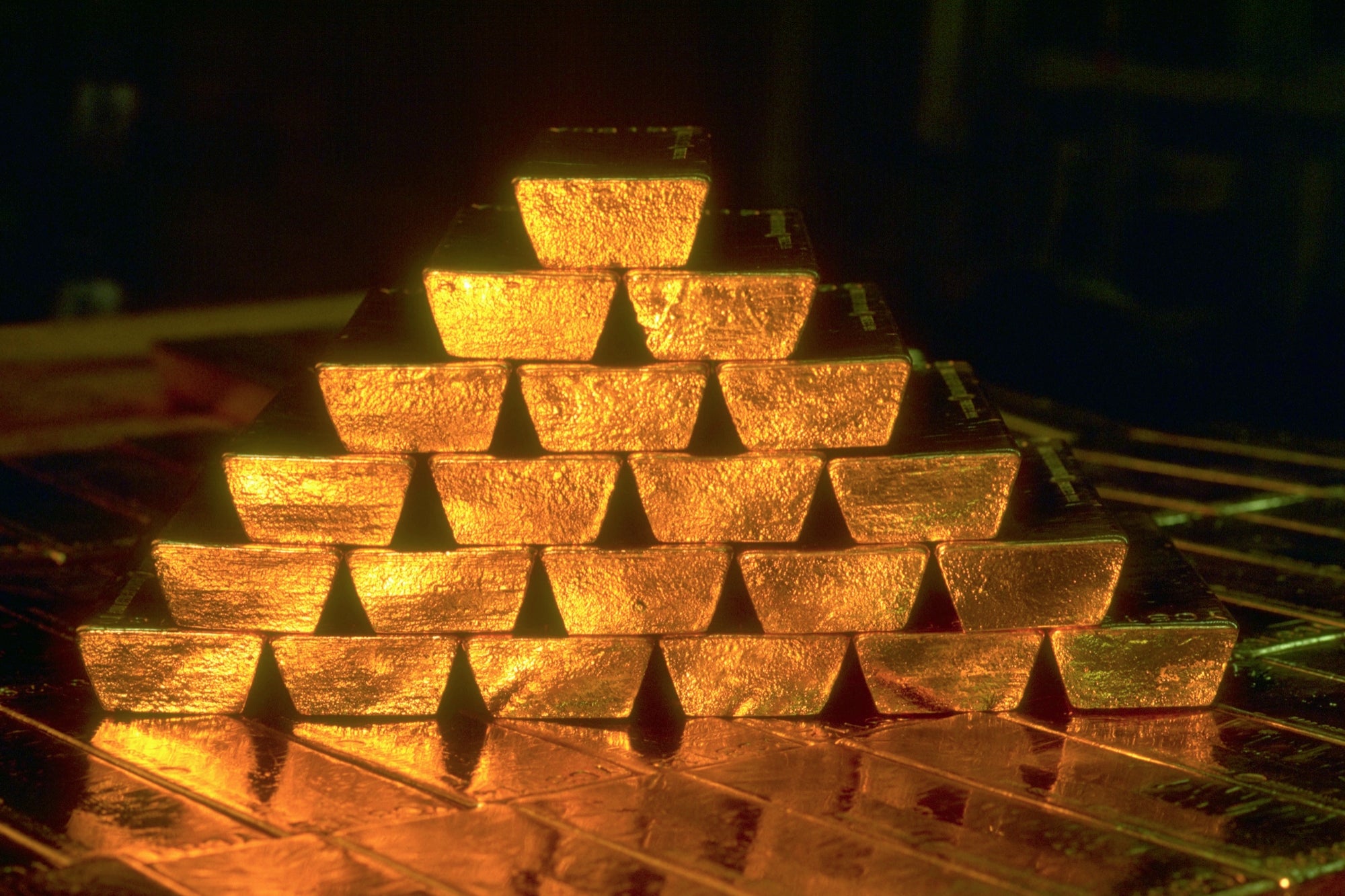

Anticipation of lower rates, which are seen as beneficial for non-interest-bearing assets such as gold, has contributed significantly to the precious metals market. As it stands, spot gold rose 0.4% to a record $2,589.02 an ounce. December gold futures similarly saw a rise, albeit a slightly more modest 0.1%, settling at $2,613.70 an ounce at the close.

At the end of Fed meeting on Wednesdaythe rate cut is expected to start a potential easing cycle. Some analysts are predicting cumulative cuts that could reach at least 100 basis points by the end of the year.

Gold's appeal as a haven asset continued after reports of a second assassination of former President Donald Trump at his golf course in Florida on Sunday. In July, after the first assassination attemptgold also rose because it is “natural” for investors to go for a shelter, Barron's reported at that time.

Amid this financial turmoil, the gold rush it was not the only important move. Platinum and silver futures also rose, rising 0.4% to $1,004.80 an ounce and 0.8% to $31,332 an ounce, respectively.

The combination of economic and geopolitical uncertainties is playing a significant role in driving experienced and novice investors to the safety of gold.