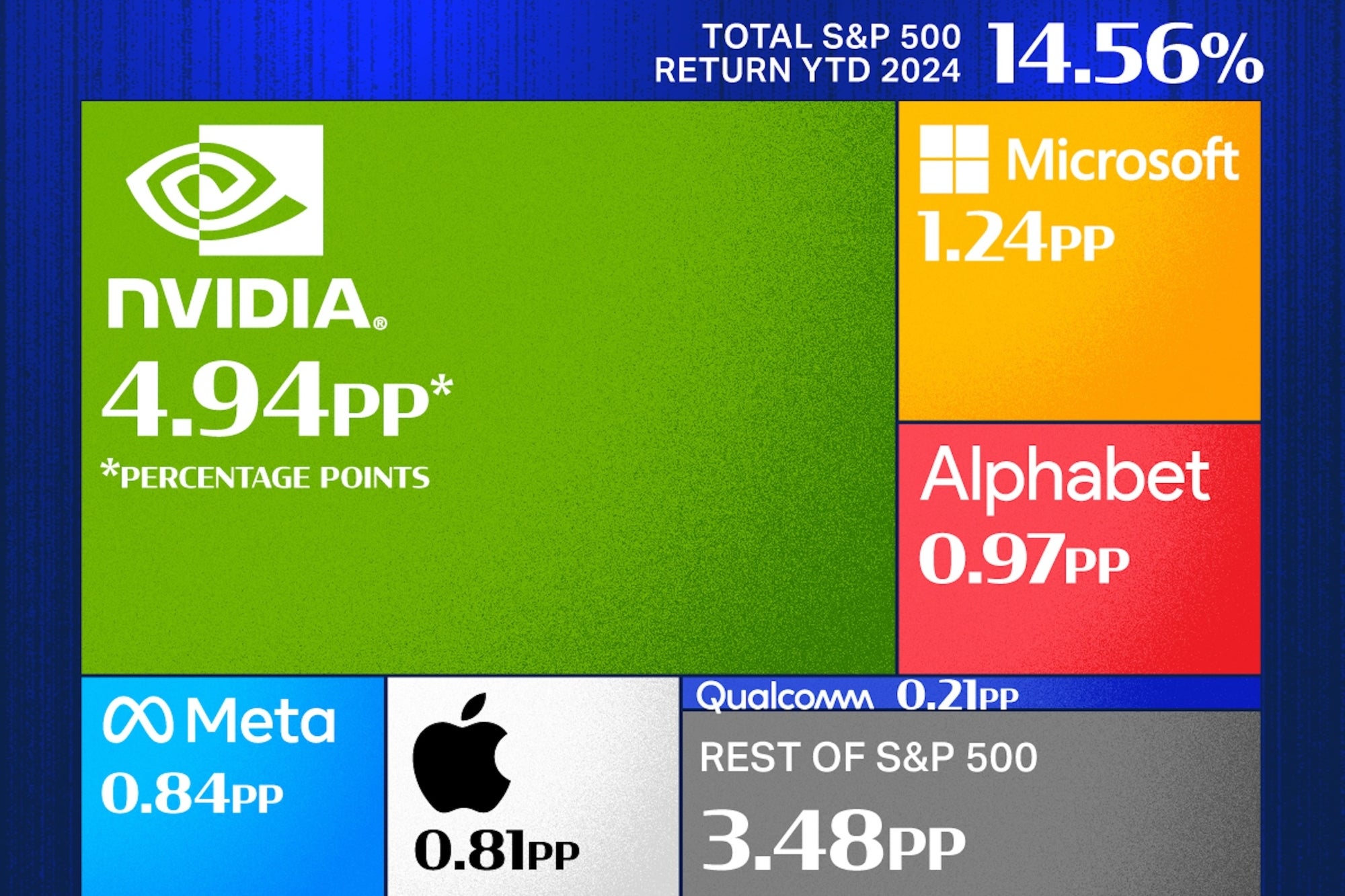

Nvidia has jumped 140% year-to-date – and it's done about a quarter of the entire 17% total gain of the S&P 500. In June, Nvidia had an even bigger impact on the index's returns, accounting for over a third of the total returns.

Demand for the company's AI chips is so high, says CEO Jensen Huang is his biggest concern.

Related: Why are Nvidia's earnings so important? They could be a 'market mover', says the expert

Although Nvidia stock may increase further this week if the Federal Reserve lowers interest ratesany increase could also reinforce concerns about the AI giant's undeniable influence on the index and what could happen to the market if demand slows or moves away from Nvidia's AI chips.

Nvidia's influence as of June 2024. Graphic by Visual Capitalist via Getty Images

Nvidia's influence as of June 2024. Graphic by Visual Capitalist via Getty Images

When Nvidia's stock fluctuates, it obviously affects the broader market; Nvidia's declines accompany declines in the markets in general.

For example, a low point earlier this month disappeared over 10 billion dollars of Nvidia CEO Jensen Huang's personal fortune in one day and over $279 billion of the company's total market capitalization. Nasdaq too fell by 3.3% and the S&P 500 by 2.1% on the day.

In contrast, when shares rose more than 30% during the two weeks ending August 21, Nvidia's market capitalization increased by $750 billion and lifted the Nasdaq by over 7%.

Changes in Nvidia's share price “could affect broader indices such as the Nasdaq 100 and S&P 500, given their strong correlation with Nvidia stock,” said Lukman Otunuga, senior market analyst at online trader FXTM . entrepreneur in an email ahead of Nvidia's second-quarter earnings report in August.

Related: Nvidia CEO Jensen Huang's biggest worry shows that success has a downside

Nvidia's performance has a deeper impact: It affects investors' perceptions of AI demand as a whole. The four companies that make up over 40% of Nvidia's profits are Amazon, Google, Meta and Microsoft — So if Nvidia's profits are up, so is interest in AI parts among major players.

Nvidia posted second-quarter earnings of $16.6 billion last month, beating expectations of $15 billion. It had its own fourth quarter in a row of triple digit growth.

The AI chip maker had one market cap of about $2.866 trillion at the time of writing and was the third largest company by market capitalization in the world.