nvidia, AI chip maker with a market value of more than $3 trillion, faced high expectations heading into its second-quarter earnings call on Wednesday. The analysts positioned the call as a “market mover” this would either justify Nvidia's high valuation or undermine it. One even said the call could be most influential in the markets than the chairman of the Federal Reserve, Jerome Powell's The Jackson Hole speech last week.

Nvidia's earnings on Wednesday, revealed after the market closed, exceeded analysts' expectations with high numbers. Nvidia reported it fourth quarter in a row with triple-digit growth, with revenue up 122% year-over-year to $30 billion. Profits more than doubled to $16.6 billion, higher than the $15 billion analysts were expecting.

However, Nvidia shares fell nearly 7% after the company shared its earnings.

“Nvidia delivered as expected, but traders are shrugging,” David Russell, Global Head of Market Strategy at the online broker. Trading Stationsaid entrepreneur in an emailed statement.

The reason may be that investors are moving away from companies with mega capitalizations like Meta and Google and focusing more “on areas like financials that could benefit from lower rates,” he said.

Related: 'Pressure cooker': Why Nvidia's millionaire employees are still working until 2 am

Financial stocks, including banks and insurers, are taking the lead over megacaps as the best-performing sector this year, Russell said in a July article. These stocks can benefit from lower interest rates that may come through Decisions of the Federal Reserve later this year.

There are other possible reasons for the stock's decline. Nvidia could simply have faced “high and unrealistic expectations”, Bloomberg Intelligence Analysts Written by Kunjan Sobhani and Oscar Hernandez Tejada. The chip maker has repeatedly beaten Wall Street estimates, so it would have to go drastically above and beyond what it has shown so far to see its stock high. Bernstein analyst Stacy Rasgon told CNBC.

“The problem is that investors keep raising the bar on Nvidia every quarter and expectations have become unrealistic,” said Jacob Bourne, one. Business analystsaid Business Insider. Nvidia's numbers were “stellar,” Bourne noted.

Related: Nvidia and Mangificent Seven have 'tremendous returns', but strategists say there are risks

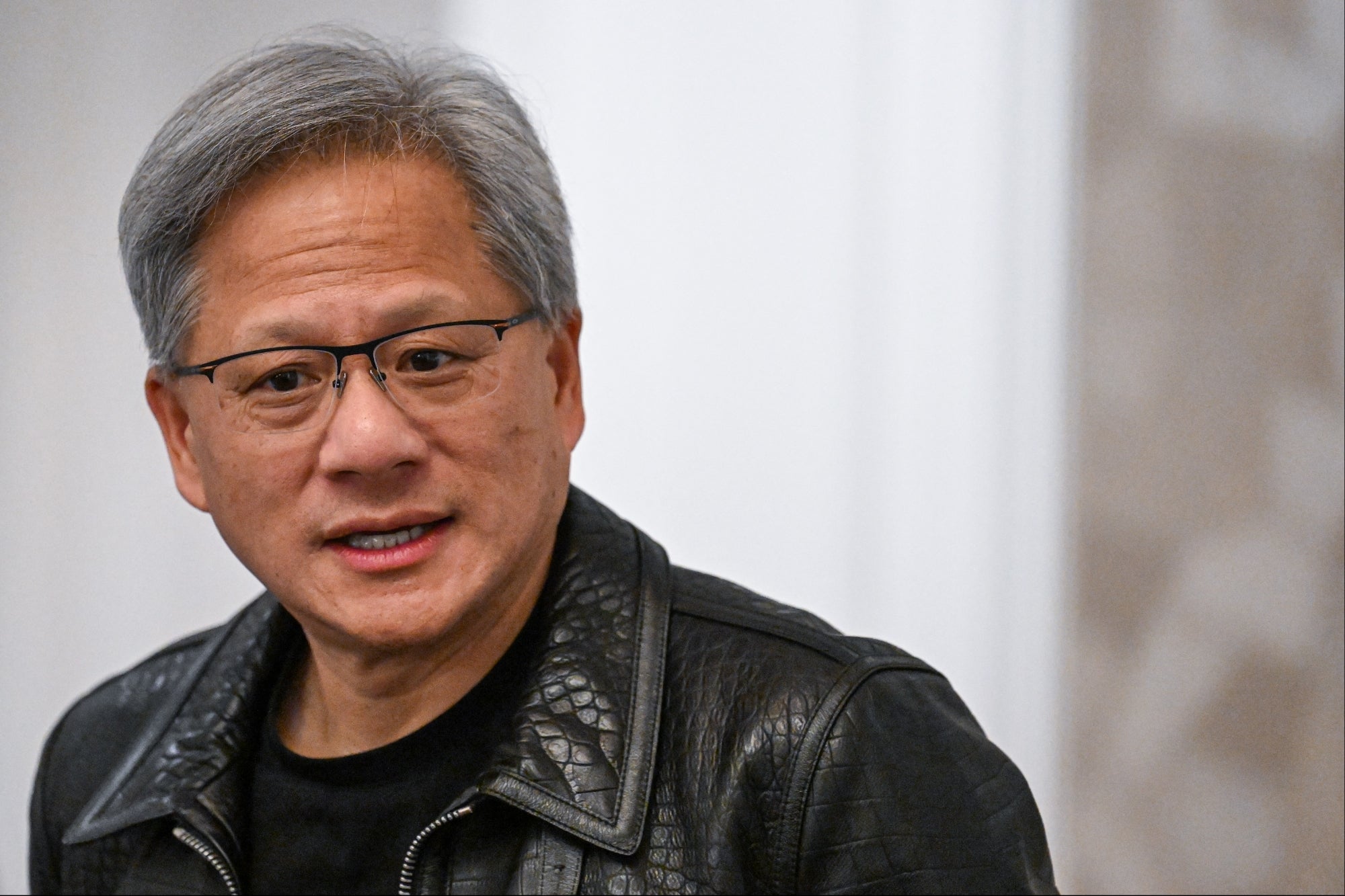

Nvidia has also faced problems in the production of its next major AI chip, Blackwell, due to design flaws, although Nvidia says it has fixed the problem. CEO Jensen Huang says the summons that “the wait for Blackwell is incredible” and that chip samples were “being sent to our partners and customers”.

Jensen Huang. (Photo by MOHD RASFAN/AFP via Getty Images)

Jensen Huang. (Photo by MOHD RASFAN/AFP via Getty Images)

Nvidia's earnings forecast for its third quarter may also have been a contributor to the company's mark loss. The company said revenue would be about $32.5 billion, which it was lower than expectations with a number closer to $33 billion.

Nvidia counts other tech giants like Microsoft and Meta as some of its biggest customers.