A $10,000 investment in AI chip maker Nvidia when it first went public in 1999 it would over 30 million dollars today.

Although investors usually aim to “buy low and sell high”, Mark Newton, a HI Morgan Stanley Technical Strategist/Vice President and CURRENT The global head of technical strategy at research firm Fundstrat takes a different approach with Nvidia: “Buy high, sell high.”

In a Wednesday episode of Yahoo Finance Stocks in Translation podcast, Newton answered a question about whether investors should buy Nvidia today or wait for it to go down.

He said he's “almost always” of the “buy high, sell higher” school of thought because an underperforming stock can take a while to rally and it's hard to tell if you've timed it right an investment.

“This is where many investors go wrong,” Newton said.

With the “buy high, sell higher” strategy, the stock proves it can perform, making it a safer bet.

“Sometimes when the horse leaves the barn, you have to go after it because it might not come back,” Newton said.

Newton revealed that he owns Nvidia stock and that two factors, risk tolerance and timing, matter most when considering buying it.

Nvidia is responsible for one third of S&P 500 earnings this year.

Connected: Elon Musk praises Nvidia CEO Jensen Huang's leadership style

Nvidia is more than 3000% The stock's surge in the past five years has catapulted the tech giant from a valuation of $346 billion in January 2023 to more than $3 trillion on Wednesday. It became for a short time the most valuable company in THE WORLD in the middle of June and now it is alone exceeded from Microsoft and Apple.

Nvidia is currently DIRECTORS The Magnificent Seven, a group consisting of Amazon, Alphabet, Apple, Meta, Nvidia, Microsoft and Tesla, in rising shares.

At the time of writing, the AI chip maker had a return of about a year per day 146%.

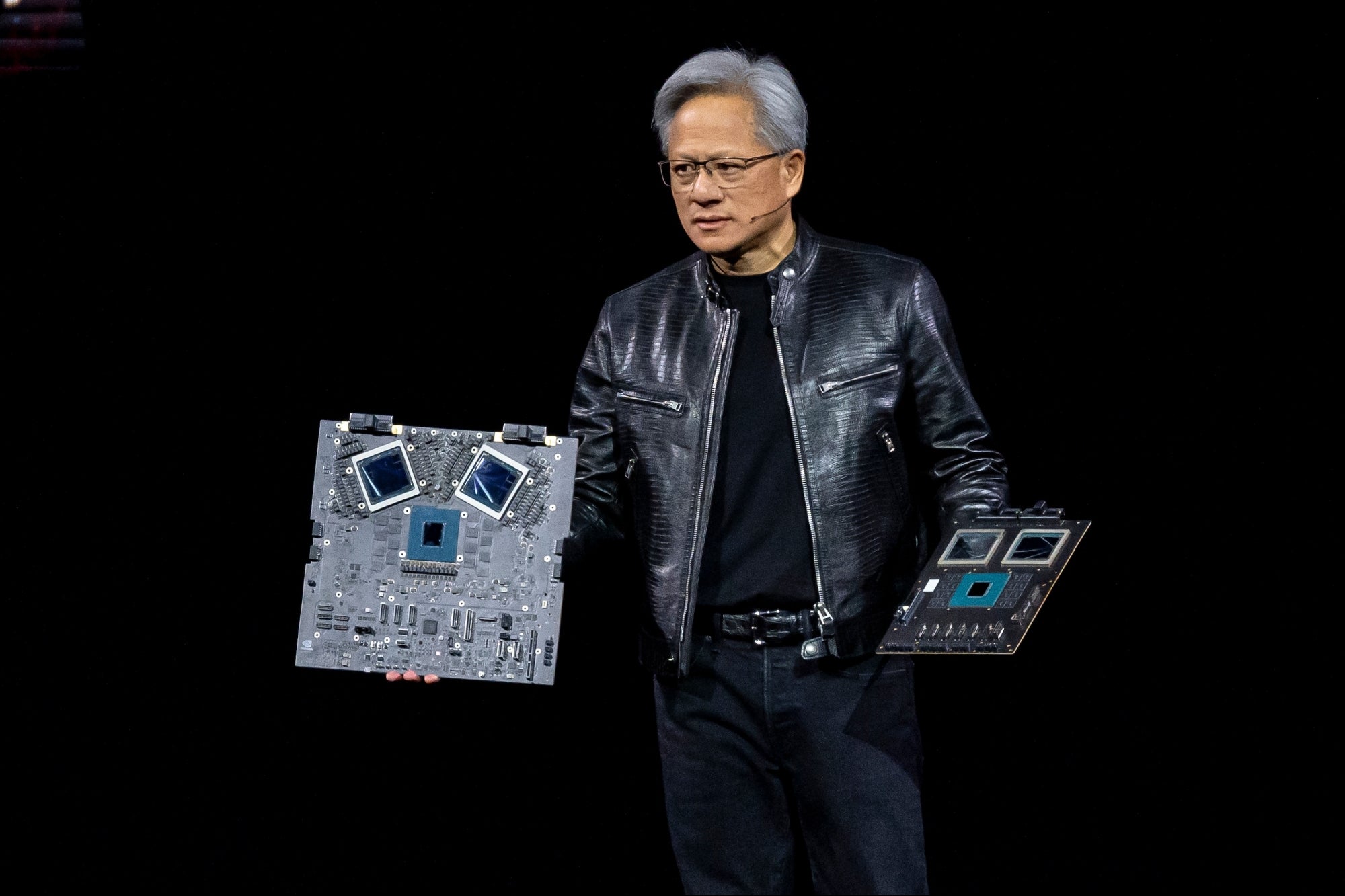

Jensen Huang, co-founder and CEO of Nvidia, shows off the new Blackwell GPU chip in March 2024. Photo: David Paul Morris/Bloomberg via Getty Images

The secret to Nvidia's growth is its graphics processing units (GPUs), which the company initially sold for gaming.

Over time, Nvidia realized that the GPUs it used for graphics tasks could also be used for machine learning and AI.

Nvidia now has more than 80% of the market share of its GPUs and chips power OpenAI's ChatGPT.

Connected: In just 5 words, Nvidia CEO Jensen Huang summed up the company's AI chip dominance strategy