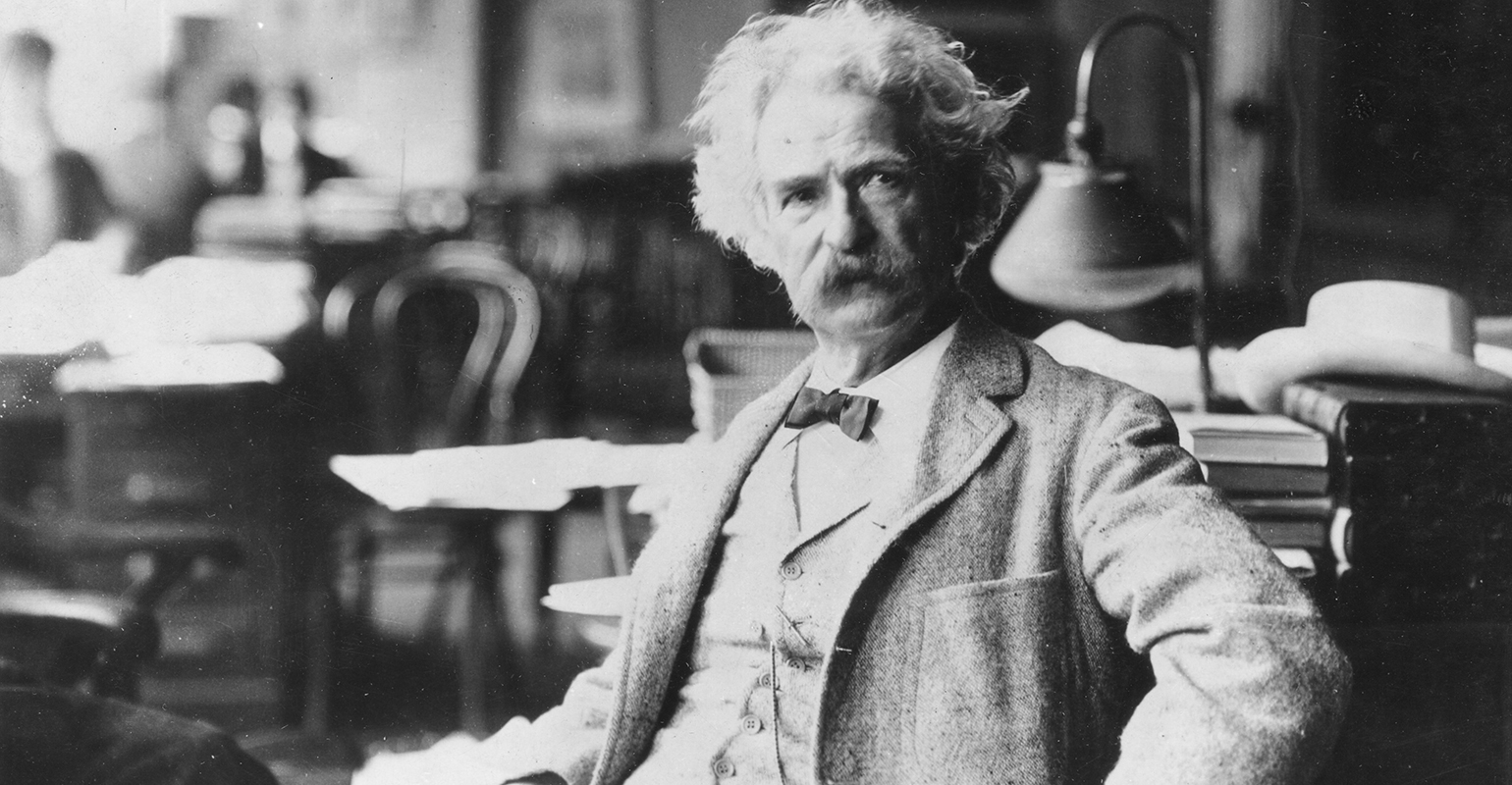

In 1897, Mark Twain reportedly read his obituary and then said, “The reports of my death are greatly exaggerated.” While some are predicting the reduction if not the destruction of landfills in part due to the growth of PEPsfintechs and the focus on cost reduction as well as increased plans from payroll providers like Paychex, the evidence seems to be to the contrary.

Most major registrars partner with independent third-party administrators, with Fidelity being the notable exception. That changed in 2023 with a group led by TPA veteran Beth Robinson, director, TPA, at Fidelity after they realized they were losing a lot of business, which, according to Robinson, makes up 60% of the sub-$50 million 401(k) market. .

Across the board, data keepers noted that the percentage of plans using a TPA, known as a split service model, has remained consistent. And although most firms like Voya offer packaged solutions, Ralph Delsesto, TPA's head of broker/dealer and distribution, said, “More than 90% of our new sales use a TPA.” Although the costs are generally higher, some providers subsidize the costs that TPAs pay directly since they are doing part of the work that the data controller would have to perform.

While TPAs generally live in the sub-$10 million market, some will go larger. A $160 million plan sponsor who recently participated in a TPSU program indicated that she depends on her TPA and would never consider giving them up. TPAs can be very useful during M&A activity.

It makes sense that non-specialists want to use a TPA since most lack a basic understanding of ERISA, while specialists tend to gravitate to the packaged model in part because they work with larger plans, but also because, according to Kasey Price, president of FuturePlan owned. from Ascensus, “Specialists tend to be less open to introducing and working with a TPA … feeling that it's easier for the data keeper to handle everything.”

An advisor at a provider due diligence meeting years ago elegantly noted the virtues of the bundled model, “There's a throat to choke.”

“PEPs have significantly impacted the number of plans using a TPA,” Price noted, but that may be mitigated by explosion of small 401(k) plans. which is expected to grow by 50% from 2021 to 2029 to almost 1 million plans, according to Cerulli, partly due to state mandates and tax credits. Deb Rubin, senior vice president at Transamerica, said that along with the TPA acting as the pooled plan provider, several plans within a PEP can use their TPA just as they can with the advisor.

Payroll providers are growing exponentially, with Paychex claiming that 70% of new sales within a PEP do not use a TPA. This is also true of most fintechs, both deploying simple plan models while seeking lower costs. Vestwell is the exception, having worked with TPA since 2022. It is led by Richard Tatum, president of Workplace Savings, who joined Vestwell two years after selling his TPA to FuturePlan to help TPAs use better technology and simplify processes such as onboarding. Vestwell also integrates with payroll providers and provides real-time enrollment information.

As long as defined contribution plans under ERISA are complex—some liken them to the gods of the Old Testament—with too many rules and too unforgiving—there will be a need for TPAs just as companies and individuals need a CPA to navigated to the Internal Revenue Code. As Hearther Windjue, AVP, TPA Services at John Hancock noted, good TPAs make the complex look simple.

But like all sectors of the DC ecosystem, TPAs must evolve and face what seem like existential threats, with some becoming an extension of the plans' HR department. Karyn Dzurisin, American Fund's TPA plan advisor, said TPAs will stay busy helping customers with payroll integration, which is essential for efficient use of automotive features.

For advisors and plans that want a simple, low-cost plan with few moving parts, TPAs are not the right option. But for the majority of the market, especially wealth advisors who want to outsource as much work as possible, TPAs are an excellent solution. In fact, the market for small DC plans exploded in the late 1990s and early 2000s when mutual fund providers like American Funds and insurance recordkeepers like John Hancock paired an advisor with a TPA to close and serve the plan.

The battle for talent has affected all sectors of the DC food chain, with several advisors noting the decline in recordkeeping service, which struggles to hire and retain high-quality talent, something many TPAs experience. These issues also plague RPAs, many of whom may seek to outsource compliance and some customer service tasks to TPAs to focus on the customer experience, as well as leverage the convergence of wealth, egress in retirement and benefits at work. Although Focus Financial's acquisition of a TPA years ago appears to have been an aberration, it would not be surprising to see others follow as they pursue opportunities in the DC market.

The questions remain:

- Can they overcome and rely on the growth of PEPs?

- Could they use AI and ChatGPT, which seem well-suited to a rules-based, data-driven service?

- Can those HR and payroll department extensions be done?

- Can they capitalize on the explosion of small plans by partnering with wealth advisors?

- Can they learn and use technology better?

- And can they better collaborate with RPAs to allow them to focus on the convergence of wealth, retirement and workplace benefits?

So while the death of TPAs is exaggerated, many face existential challenges and only those willing and able to adapt will survive and thrive.