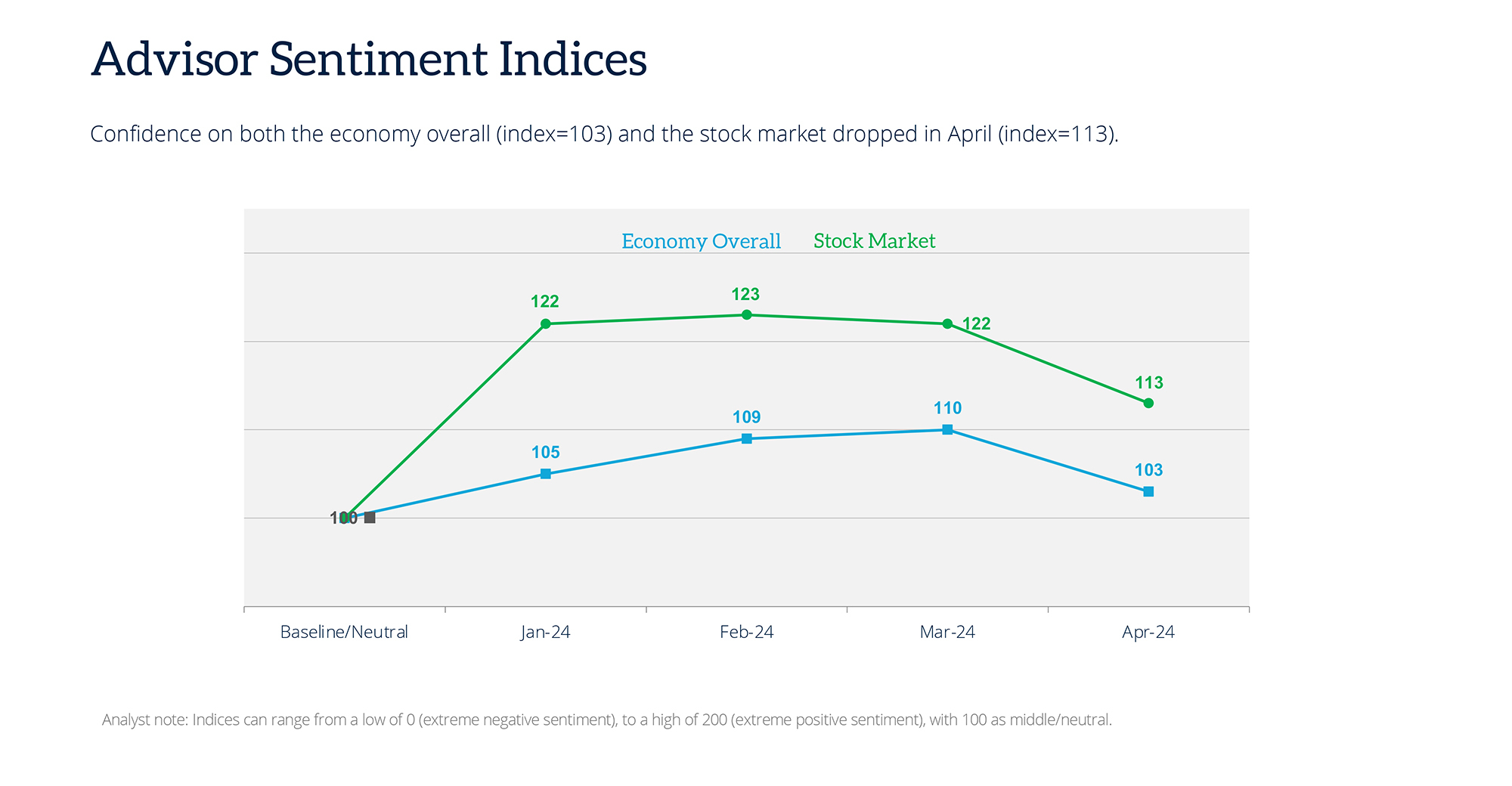

Financial advisors' sentiments about the stock market and the economy fell in April.

The health of the economy fell nine points from last month, while advisers' confidence in the stock market fell to 103, from 110 in March. A response of 100 equals a neutral view.

According to the survey, councilors are divided about the current state of the economy, with 39% expressing a positive sentiment, 40% neutral and 21% feeling negative.

Looking ahead, advisers are more pessimistic, with 36% expecting a decline in the next six months. Only 20% see an improvement coming. Looking ahead 12 months, however, the trend reverses, with 40% expecting an improvement and 39% predicting a decline.

As for the stock market, the advisors are Bulgarian, with 59% considering the current situation positive. However, looking six months ahead, advisers are negative. Looking ahead to March 2025, they become slightly more positive, with 51% expecting an improvement.

Of course, persistent inflation, the delay in lowering interest rates and the upcoming presidential election are all reasons for the advisors' views.

Methodology, data collection and analysis by WealthManagement.com and Informa Engage. Data collected April 15-25, 2024. Methodology conforms to accepted marketing research methods, practices and procedures. Starting in January 2024, WealthManagement.com began promoting a short monthly survey to active users. Data will be collected within the last ten days of each following month, with a target of at least 100 financial advisor respondents per month. Respondents were asked about their views on the economy and the stock market as of now, six months from now and one year from now. The responses are weighted and used to create an index tied to a neutral value of 100. Over time, the ASI will provide targeted sentiment of retail financial advisors.