Leading financial planning technology provider RightCapital has launched RightRisk, its new risk tolerance measurement tool. Now, the tool is automatically available as part of the company's premium and platinum subscriptions.

RightCapital has been in a growth slump over the past few years and has remained firmly in the no. 3 among financial planning platforms with just under 15% of the market in the T3 Software/Inside Information Advisor 2024 Survey. Now, the provider has rolled out its risk tolerance questionnaire and tool, a move that addresses a frequently requested feature from his advisers.

WealthManagement.com spoke to two advisors, both provided by RightCapital.

Peter Newman, founder of Peak Wealth Planning, said he has been using RightCapital for three years. Before that, he used MoneyGuidePro for planning and Riskalyze for his risk analysis (and before that, Morningstar's risk questionnaire).

“I liked Riskalyze overall, but seven out of 10 of my customers would easily understand the results (the generated risk score), and the last three went 'huh'—and then Riskalyze raised their prices,” Newman said .

He added that he likes the way RightRisk integrates with the rest of RightCapital's planning capabilities.

“What I also liked is that I can upload their (customer's) result and document that I did it – I thought it was a simple and straightforward solution,” Newman said.

Another advisor who has tested the new tool is Matt Cook, founder and CEO of Stoic Private Wealth, based in Conover, NC.

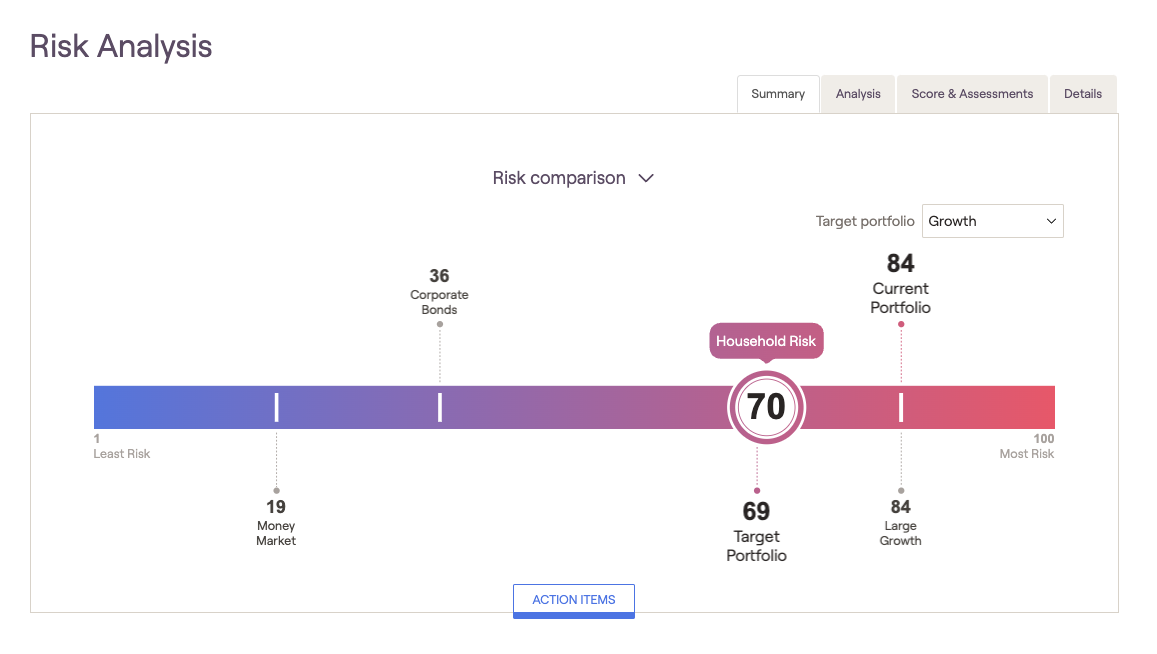

The RightRisk tool's risk comparison shows how an overall household risk score compares to the current portfolio, target portfolio, and key asset classes.

Advisors can use RightRisk's default 13-item questionnaire, which is based on the Grable and Lytton scale, or create their own. The ability to customize the questionnaire is an attractive feature for Cook.

“We have a very specific way we like to ask questions about risk tolerance, and this gives us the ability to tailor that to our business,” he said. His practice works primarily with airline pilots for whom he provides comprehensive planning (American Airlines has a hub in nearby Charlotte).

“The biggest thing, the reason we told RightCapital we wanted to include this was to simplify our platform,” he added. Cook said he didn't want to add a tool from another company to his technology stack.

Among other features of the RightRisk tool is a family risk summary, which illustrates the family risk score and how it compares to the current portfolio, target portfolio, and key asset classes. There is also a visual risk-return analysis that can help end clients understand the potential positive and negative returns of their investment portfolio and key asset classes.

“We retain all the feedback we receive from clients, and having a risk tool was among the top requests we received over time,” said Shuang Chen, co-founder and CEO of RightCapital.