The popularity of direct indexing has rose up, with assets invested in direct indexes exceeding $260 billion at the end of 2022. This approach, which involves investing in the individual securities that make up an index rather than the index fund itself, offers a unique combination of benefits. Not only is it intended to allow investors to closely replicate the performance of an index, but it can also significantly increase tax efficiency.

Further, direct indexing offers a level of customization far beyond the capabilities of conventional index funds, making it an increasingly attractive option for those looking to tailor their investment strategies.

Direct indexing is gaining traction, and rightly so. Let's examine some of the more compelling tax benefits of this strategy, in addition to customization and diversification.

Harvest losses may be additional to direct indexing returns

Direct indexing has several advantages over off-the-shelf index funds, where investors hold a diversified basket of stocks but lack the ability to manage individual components for tax purposes. Through direct indexing, investors can sell securities that have declined in value to offset taxable gains elsewhere in their portfolio, potentially reducing tax liabilities and increasing tax efficiency. This process is known as tax loss harvesting and can help improve after-tax returns. However, it is important to navigate this strategy within its limitations wash sale rulewhich prohibits claiming a tax deduction for a security sold at a loss if a substantially identical security is purchased within 30 days before or after the sale.

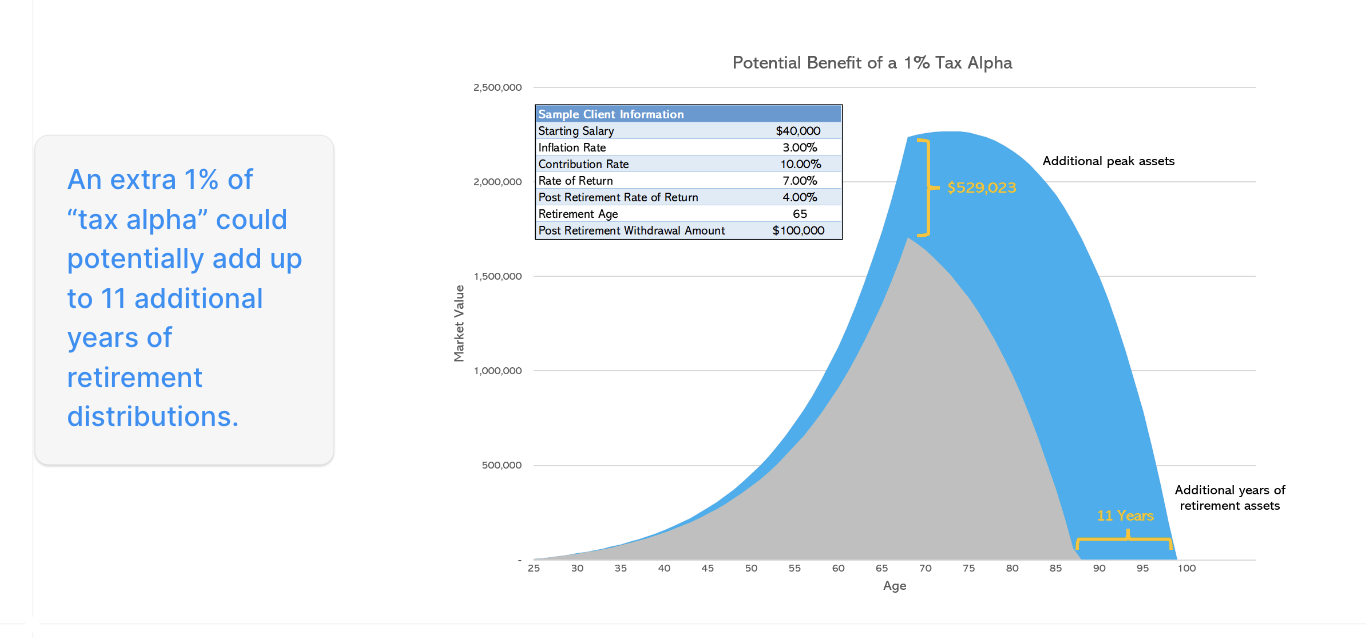

Consider an example where Microsoft is up 15% year over year, while another equity is down 20% with deteriorating earnings. By investing directly in each stock rather than through shares of an index fund, investors have the ability to filter out underperforming investments and, in turn, offset up to $3,000 of taxable gains or ordinary income. An investor using a direct indexing strategy has the opportunity to exit the weak position at a loss, which can help offset any gains realized in Microsoft. Advisors who deploy this strategy can potentially strengthen client relationships and differentiate their practice, as evidenced by the example below where an additional 1% in pre-tax alpha can equate to approximately 11 years of additional retirement distributions.

Reduction of concentration risk

Another prime example of the potential advantages of direct indexing lies in company stock plans. An executive at a tech giant like Microsoft can accumulate significant amounts of company stock over time at a low cost basis. This can cause an individual's wealth to be quite unbalanced, with a portfolio overweight in one position. Investors have the option to balance this through the use of direct indexing.

This could involve modeling a portfolio after an exchange-traded fund that counts Microsoft as its main holding. Through direct indexing, the holder of a large position in Microsoft will be able to mimic the structure of the fund while excluding their concentrated stock. This allows them to customize their portfolio to reflect the broader market exposure of an ETF, strategically avoiding additional investments in stocks where they already have significant exposure.

This strategy is not just for executives who hold significant shares of the company. Consider advising a client who took a position at Nvidia several years ago. They are likely to have significant, unrealized gains thanks to the stock's outstanding performance. Direct indexing enables the customer to track the broader market while forgoing further Nvidia acquisitions. This strategy facilitates portfolio diversification and enables them to strategically engage in tax loss harvesting, potentially offsetting the losses of the weaker stocks against gains in Nvidia stock.

Maximizing legacy wealth through selective loss harvesting

Asset inheritance presents another opportunity for direct indexation, along with loss harvesting, to help lower the investor's tax bill. When someone inherits wealth, they get a step up on the cost basis of these assets at their fair market value at the time of the original owner's death.

This increase in cost basis can reduce or eliminate any built-in capital gains tax liability. However, heirs may still incur capital gains taxes on any subsequent appreciation of these assets. It is advisable that they review their portfolio to identify securities that have depreciated since the date of inheritance. Once they have identified the “losers,” they can selectively sell individual securities with unrealized losses to offset any capital gains realized elsewhere in their portfolio.

Direct indexing as a competitive advantage for advisors

Direct indexing has earned a reputation as a tax optimization tool and as a channel for deeper client-advisor connections. By better aligning investment strategies with clients' objectives, ethical considerations and risk preferences, direct indexing enables advisors to offer tailored solutions that go beyond traditional investment vehicles.

By combining tax optimization with portfolio customization, direct indexing can serve as a differentiator for advisors looking to grow their practice in an increasingly crowded and competitive market. This can serve to demonstrate the advisor's commitment to providing personalized and thoughtful investment guidance while providing added value to clients.

Nathan Wallace is a wealth manager at Smart advisors Inc. a digital-first platform for financial advisors that is focused on modernizing the human financial advisory experience.