How to use the POWR options approach for combining fundamental, technical and implied volatility analysis with a recent RIO trade as an example.

One of the screens we use in the POWR Options trade selection process involves comparing recent performance to help identify underperformers in Strong Buy (A – Rated) stocks.

The expectation is that this relative underperformance will be short-lived and these A-rated stocks will do relatively better over the coming weeks. Bullish calls are bought on these Strong Buy stocks at temporary discounts to take advantage of expected performance.

Technical and implied volatility analysis is also used in the decision-making process.

A quick walk through a recent trade in Rio Tinto ( RIO ) launched on April 1 can help shed some light on the process.

Rio Tinto was one Strong buy shares valued at POWR valuations. Ranked #1 out of 33 in the Industrial-Metal Industry. The better it gets.

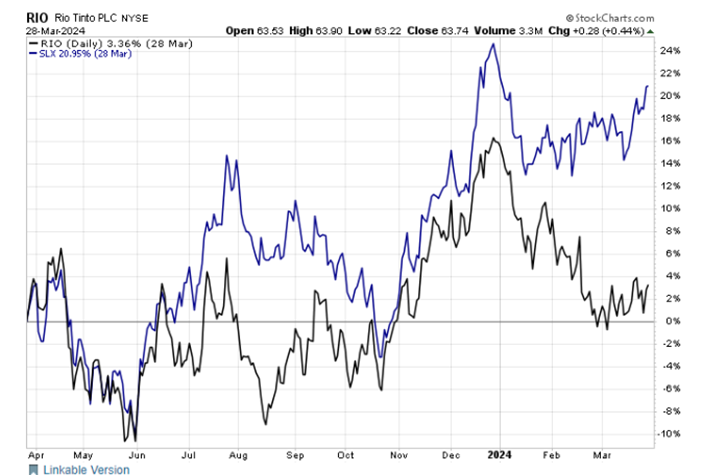

However, RIO, a leading global steel producer, had dramatically underperformed the steel index in recent months.

Indeed, this underperformance had reached an extreme, as seen in the six-month chart below. Rio Tinto was up just over 3% over the past six months, while SLX had gained almost 21% over the same time period. The performance gap was now at 17.59%. This despite the fact that RIO is the largest component to just over 10% in the Steel Index.

RIO stock was finally showing an improvement in price action on technical grounds on April 1st. Shares had broken above the 20-day moving average after reaching oversold readings.

Implied volatility (IV) was also very reasonable at just 13%. This means that option prices were only cheaper than this 13% of the time last year.

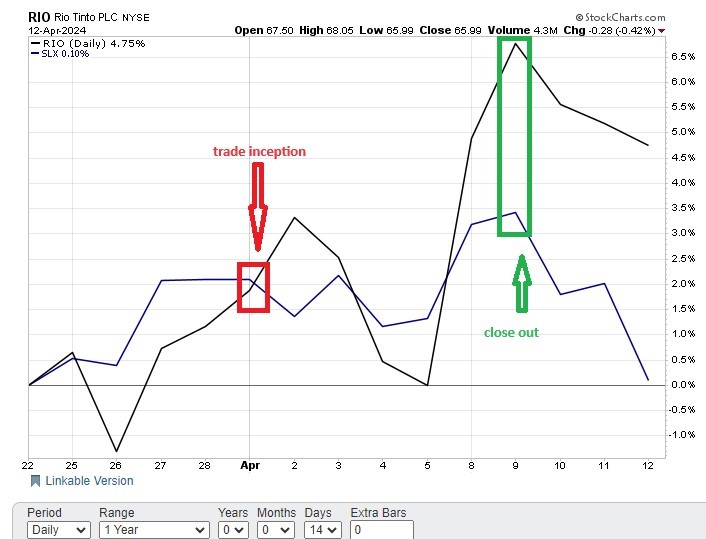

POWR Options issued a trade recommendation on April 1 to position a pop on Rio Tinto. Current trade was to buy 7/19/2024 RIO calls at $62.50 @ $5.00.

Fast forward to April 9 and the expected performance from the RIO against the SLX was starting to show. Rio Tinto shares were up around 3 points (5%). RIO shares had also closed the performance gap against SLX from 17.59% to 12.20%.

POWR Options issued a close on April 9 to sell Rio calls at $6.70. The performance spread had converged and RIO shares were becoming overbought and facing general resistance on technical grounds.

The 9-day RSI approached the 70 level. Bollinger Percent B crossed 100. The MACD hit a recent extreme. The stock was trading at a large premium to its 20-day moving average. RIO shares had trouble breaking through major resistance at $67, as we noted in the enclosed email.

POWR Options bought RIO calls on April 1 for $5.00. It closed out those calls on April 9 at $6.70 for a 34% gain. The holding period was 9 days. Not bad for a few weeks work.

Shares of RIO moved from $64 to $67 in the same 9-day period. A very respectable profit of just under 5%.

So while the stock rose just under 5%, the calls rose nearly 35% or 7 times the amount of the stock. It highlights the powerful leverage that options can provide.

Not all trades work this well or this quickly. After all, trading is about probability, not certainty.

Those looking to increase their chances of success may want to take a closer look at POWR Options.

POWR options

What should be done next?

If you are looking for the best options trading for today's market, you should check out our latest presentation How to trade options with POWR ratings. Here we show you how to consistently find top option trades while minimizing risk.

If this appeals to you and you want to learn more about this powerful new options strategy, then click below to access this timely investment presentation now:

How to trade options with POWR ratings

All the best!

Tim Bigham

Editor, POWR Options Newsletter

Shares of RIO closed at $65.99 on Friday, down $-0.28 (-0.42%). Year-to-date, RIO is down -7.71%, versus a 7.81% gain in the benchmark S&P 500 over the same period.

About the Author: Tim Biggam

Tim spent 13 years as Chief Options Strategist at Man Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim and 3 years as Market Maker for First Options in Chicago. He makes regular appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Network “Morning Trade Live.” His main passion is making the complex world of options more understandable and therefore more useful for the everyday trader. Tim is the editor of POWR options newspaper. Learn more about Tim's story, along with links to his most recent articles.

Post How to buy the best stocks at the best time appeared first on StockNews.com