The death of Daniel Kahneman, an Israeli-American author and psychologist, got me thinking. Like me, Kahneman had deep ties to my hometown of Chicago. While we never met, I admired his Nobel Prize-winning work in behavioral economics and his explanation of the important role of psychology in financial decision-making. For example, he pioneered work involving the “regret minimization strategy,” which helped investors build a portfolio based on how much they thought they could risk and still sleep at night. He also praised “loss aversion,” noting that people feel the sting of an investment loss more than the joy of a gain. He also established that making more money does not necessarily make you happier. Depending on where you live, Kahneman found that earning more than $70,000 to $90,000 a year won't make you happier as long as you're meeting basic living expenses.

One of the things that my business partner, Craig Stone, and I talk about all the time is the quality side of planning. This is very different from the quantitative side, where most advisors like to spend their time. We have found very little cohesion between what the family wants and what is put on paper. I can't tell you how often an attorney or CPA calls me at the last minute and says, “Randy. I have a client with this problem. What is the solution?”

It's like walking into a doctor's office and saying, “Doc. I don't have time for tests or X-rays. Just write me a prescription.”

In those situations, I tell the counselor that I'm happy to help, but it's hard to recommend a solution until I understand who your client is, how they're connected, and their goals for themselves and their loved ones. It's about taking the time to have meaningful discussions with customers and asking questions that no one else is willing to ask. Sometimes, you have to challenge customers and push back to arrive at the best possible solution. To do this, you need a mixture of mathematical, legal and psychological skills. Our profession is full of people who are great at mathematical and legal matters, but not so accomplished at understanding human emotions and psychology.

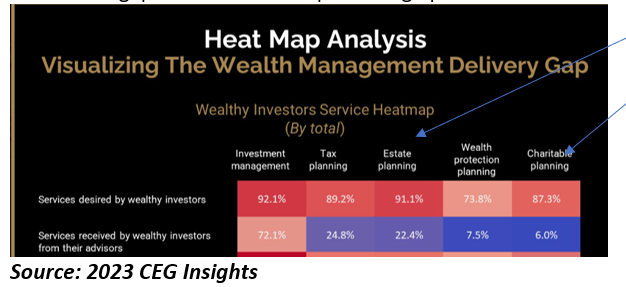

And that's why there's such a big gap between what successful clients want and the services they say they're getting from their advisors. For example, in a 2023 survey of over 1,100 wealthy investors and financial advisors by CEG Insights (see chart below), 91% of wealthy investors sought estate planning services. However, only 22% said they were getting these services from their advisors – a gap of nearly 70 percentage points! Further, 87% of wealthy investors said they sought charitable planning services from their advisors, but only 6% received those services – a gap of more than 80 percentage points!

What is taught in every financial course and certification program these days is the technical/analytical structure of planning. It does not take much time to understand the human mind. And this is a big problem, because planning entirely from a mathematical and legal perspective means that there is always a definitive answer to any question or issue. Everything balances out. You are allowed to do this. You are not allowed to do this. There is not much gray area here. But that's what real life is.

So counselors need to develop empathy, deep listening skills and good questioning. Many think these skills are innate, but I found you can learn to develop those “soft skills”. The challenge is that most legal and financial practitioners determine how intangibles fit into their business model. They can't figure out how to get paid for that kind of expertise. But the modern counselor must approach each client as a person, not as a case. You need to know their values and motivations because what we are trying to achieve must last for many generations. We want to get it right the first time; we don't want to keep doing it repeatedly.

Another problem with counselor training is that young professionals are not learning how to show their vulnerability. They don't like to admit to clients that they don't always know the answer. But sometimes, you have to be brutally honest about what you're good at (and more knowledgeable about) and what you're not. The leaders of the pack are those who know what they are best at and leverage those skills while hiring the best people they can find to fill their knowledge and expertise gaps.

If a client trusts you with intimate details about their estate planning and bequests, “fake it till you make it” won't fly. They have a lot of money, and multiple generations of their family depend on you to help them make the right decisions. Put your ego aside and get the training you need, or find a skilled professional to help you. It seems like we lost an entire generation of estate and gift planners thanks to the Tax Cuts and Jobs Act of 2017 that raised the exclusion limit into the stratosphere (until 2026). Soon we will be playing catchup in a very big and painful way.

Randy A. Fox, CFP, AEP IS THE founder of Two Hawks Consulting LLC. He is a wealth strategist, philanthropic estate planner, educator and nationally known speaker.