Some of America's biggest companies, including Tesla, T-Mobile and Netflix, were at the center of a new report that reveals how much the companies paid in federal income taxes — compared to how much they earned and what they paid the most. . the leaders.

The Institute for Policy Studies and Americans for Tax Justice issued a REPORT On Wednesday, it highlighted “a significant number” of large US companies, 35 in total, that paid their top five executives more than they paid in federal income taxes between 2018 and 2022.

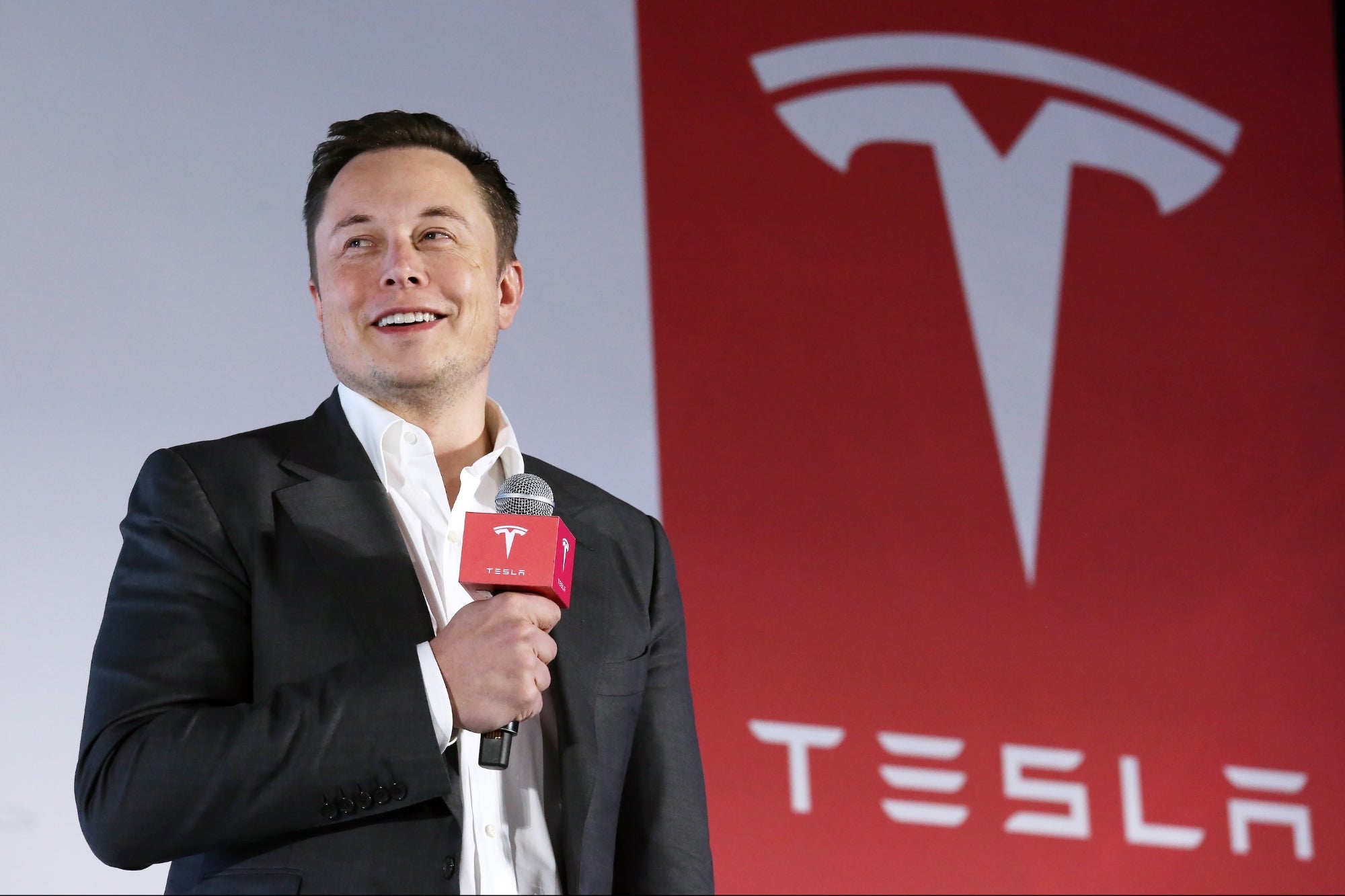

Elon Musk's Tesla was no. 1 on the list. The company paid its top five executives $2.5 billion over five years, while bringing in $4.4 billion in U.S. profits.

Tesla Motors CEO Elon Musk speaks to the media next to his Model S during a press conference in Hong Kong. 25 JAN16 SCMP/ Nora Tam (Photo by Nora Tam/ South China Morning Post via Getty Images)

Tesla Motors CEO Elon Musk speaks to the media next to his Model S during a press conference in Hong Kong. 25 JAN16 SCMP/ Nora Tam (Photo by Nora Tam/ South China Morning Post via Getty Images)

According to Bloomberg Billionaires Index. Musk is one of the three richest people in the world.

The report points out that despite Tesla record profits, the company “has never paid a nickel in federal income taxes.” One possible cause of this trend, according to the report, could be Tesla carrying losses before it became profitable.

“These losses dampen the often boom-boom nature of corporate finances,” the report said.

Connected: Electric car startups 'Next Tesla' hit fast: 'Investors want to see demand'

T-Mobile was second on the list, with a profit of $17.9 billion in the US over five years and zero federal taxes on net income. The top five executives there were paid $675 million from 2018-2022, according to the report, with CEO and president Mike Sievert getting $158 million of that total.

There are a number of tax avoidanceor tax minimization, strategies mentioned in the report, including shifting US profits to offshore tax havens or exercising stock options tax deductions.

The report does not take into account state, local or payroll taxes.

Connected: Elon Musk warns Tesla workers will sleep on production line to build its new mass-market vehicle