Yeardo has its risks, and 2025 is no exception. But before we respond to the latest market turbulence, let's go back to understand how we got here and what it means for your investments.

Penalty and gloomy titles

Over the past 10 days, investors have faced a wave of disturbing news. The University of Michigan University's consumer index fell to the lowest level since November 2023. Warren Buffet's annual letter revealed that he has increased his cash. US consumers' expenses dropped in January for the first time since March 2023. Atlanta's GDPNOW Federal Bank projects a decline in the first quarter, which, if it were accurate, would be the first contraction in GDP since 2022. Increasing uncertainty, after a 30-day delay. 25% fee in imports from Mexico and China starting from an additional stunt.

This level of uncertainty is worrying for investors, as markets do not like insecurity. As a result, S&P 500 has dropped 6 percent in just a few weeks, with the best reserves of last year leading the fall. While these points of impact influence, opening back and putting things in perspective is important. Despite negative titles, the market is still only 6% below its high level and has returned to the levels seen in early January this year.

Pockets of force

Despite negative titles, not all market share are fighting. While Customer Cyclical Technology and Cyclic Shares – the big winners of the last year – have led the last decline, other sectors are holding well. Consumer staples, health care and financial services have had stronger secondary returns. As measured by the EX-USA ACWI index, international shares have increased 6.3%. Moreover, the US General Bond Index is also 2.7% this year. In short, diversification is again proving its value after a long period where it did not seem to help so much.

Market corrections occur every year

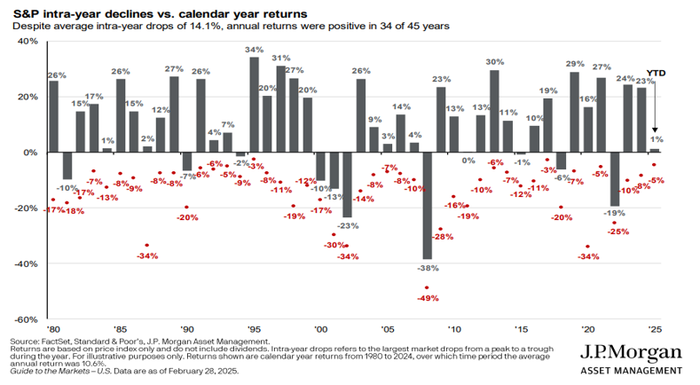

As market withdrawals never feel well, they happen regularly:

Click here for a larger version

Even in the strong years, shares markets tend to experience a decline in the range of 5% -10%, and these corrections can be healthy.

Looking at history provides a perspective. In 2018, the S&P 500 fell in the first quarter, gathered in the middle of the year, and fell back to the fourth quarter between trade wars and increasing interest rates. However, this set the scene for a strong recovery in 2019. Similarly, in 2022, markets fell for three in a row before meeting in the fourth quarter, starting two years. These examples point out that short -term falls do not necessarily indicate long -term trouble.

Opportunities in instability

Market time is extremely difficult, but periods of instability often create opportunities. Warren Buffett famously advised investors to “be afraid when others are greedy and greedy when others are afraid.” While this advice sounds simple, emotional reactions make pursuit difficult. However, history shows that the best times to invest occur when the feeling of the market is at worst.

While instability can continue and even grow, future economic data can help ensure investors that the economy remains strong. The lower US 10-year treasury rates can lead to lower mortgage levels, providing additional support.

Now it's a good time to review your investment strategy. The market will always be dynamic, but staying adaptable, awarding short -term noise and focusing on your long -term goals are essential. If market fluctuations create opportunities that do not reflect current economic bases, investors should use them to improve portfolios. Continue to continue.