During his latest hearing on the confirmation of the US Senate, the Nominant of the Secretary of Trade Howard Lutnick repeatedly emphasized the Trump administration's view that other nations did not “respect” the United States in relation to global trade.

“My way of thinking … is the place by place, the macro …” he said. “We can use fees to create reciprocity, justice and respect.” Lutnick, however, left open the opportunity for Mexico and Canada to avoid extensive tariffs if they can quickly meet the demands to curb the course of illegal immigrants and Fentanil on their borders. We saw this show this week with 25% tariff delay for one month as the latest signal of fluid trade scenarios.

With the seemingly “reciprocity” negotiations in the Trump 2.0 era, global investors have clashed to knowledge of foreign policy positioning and indications of how far foreign leaders may be ready to Kowtow for President Donald Trump's advantages.

Given, for American investors, the country's prejudices and review prejudices are difficult to shake, given the mega-chapter predominance of American technology actions. For 2024, the total returns of the seven wonderful companies made up more than half of the return of S&P 500 (+24%).

But American actions are also overrated. The price ratio to the profits for the S&P 500 index from January 30, 2025 was 25.63-Mirs above its 10-year average. Stock estimates have not yet reached euphoric levels of points, but inflation threatens to diminish optimism, a less concentrated portfolio can help relieve instability.

In front of artificial intelligence, we believe that the tendency should continue to promote stock market profits for the long run. The last call of the awakening presented by China's Deepseek – the new model of he's challenging assumptions on the superiority of American technology – reverses the need for diversification. It also strengthens our belief that investors should remain in mind about the global opportunity set for differentiated risk and return.

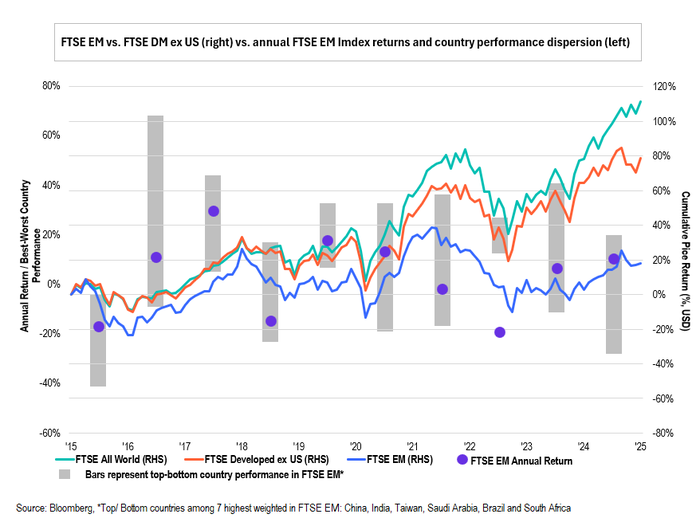

Keep in mind that Beijing stimulus measures at the end of last year helped increase China's return, which ended nearly 19.5%-becoming China among the best developing markets last year, along with Taiwan, which returned 17.5%. In the future, investors need to expect significant short -term market instability, especially given the increasing uncertainty about the new US administration policies.

Should trade tensions be facilitated, and the rebalance of China's economy, we expect a return to luxury tourism -related expenses. Pre-Pandemic, Chinese consumers were among the most predominant segment of luxury goods buyers. Asia held Most luxury personal goods This time last year with 38%. And while the consumer's trust faded during the year, resulting in a decrease of approximately 19% In luxury spending, analysts still predict a long -term expansion of the luxury market, mainly driven by the growth of middle -class customers from China and India.

Global spots bright

Given the spread of the new trading block and networks that exclude the United States in this new era of protectionism, we encourage investors to consider opportunities abroad in maintaining an elastic portfolio. In particular, we have witnessed India taking a more commanding role in global affairs. Two years ago, India blazed its growing diplomatic influence as a hospitable for the first time at the G20 summit, where it helped hit the agreements and officially welcomed African unity in the G20 block.

India has signed more than a dozen free trade agreement with regional partners to increase export -oriented domestic production in the last five years. Prime Minister Narendra Modi has defended a “strong, personal” relationship with Trump and quickly expressed his commitment to a strategic partnership with the US in a recent move, Modi pledged to cooperate with the US to repatriate about 18,000 unmarked Indians living in the US

When it comes to historically broad distributions in the return of foreign markets, we believe that this is not only opportunities but also benefits of diversification. China's solid market returns 2024 came after its wide market fell almost 12% in 2023, following other developing economies. We believe that China's stock estimates remain relatively attractive now, at 11.4x, approximately 15% lower than its 10-year average.

Meanwhile, the Mexico market, which was the highest interpreter of EM in 2023 (nearly 40% given the near tail), saw that the stock market returns fall about 28% for 2024.

To some extent, investors' interest in Brazil also seems to be returning to the potential for higher oil prices. US tariffs aimed at Canada and Mexico, however, can cause an increase in currency -related inflation in Latin American economy and may obscure the Central Bank's view of interest rates. Unlike nations on the direct line of US tariff fire, Brazil has a commercial deficit with the US, its second largest trading partner, who can provide her with a relative benefit. Despite its fiscal reform and inflationary obstacles, the relatively young Brazil population and the low unemployment rate offer some positive aspects. Latin American economy remained a diversifier in the EM range, with a 7.2x P/LTM, nearly 50% discounts of broad EM countries/regions.

We also see Japan as well positioned because of its improved corporate governance, which has removed the sense of market. Japan is one of the largest overseas investors in the US, which make up 15% of total ownership of foreign cumulative direct investments since the end of 2023, according to data from the Economic Analysis Bureau. Canada is the second largest investor, with 14% in US shares, followed by Germany and the United Kingdom.

Unlike the most south -oriented chips sector, Taiwan's performance was led by him by a range of chip shares and the supply chain around them. The increase and visibility of profits in profits should continue to do well for Taiwanese technology firms.

While the interaction between the macro and fundamental issues of the world continues to be difficult to analyze, the case of dividing international exposure by dividing into single countries remains strong.