Registered investment advisers began the year with high levels of optimism in the current and future state of the economy and the stock market.

The optimism of the counselor in the stock market marked marginals upwards to start the year in a 126 reading, according to the Sentiment Ria Edge Advisor index (100 reflects a completely neutral appearance.)

This is the second highest rating in the stock market since the beginning of 2024, almost matches the level expressed in November.

Almost 7 of the 10 councilors, 71%, consider the market status to be positive. Only 2% express a negative appearance.

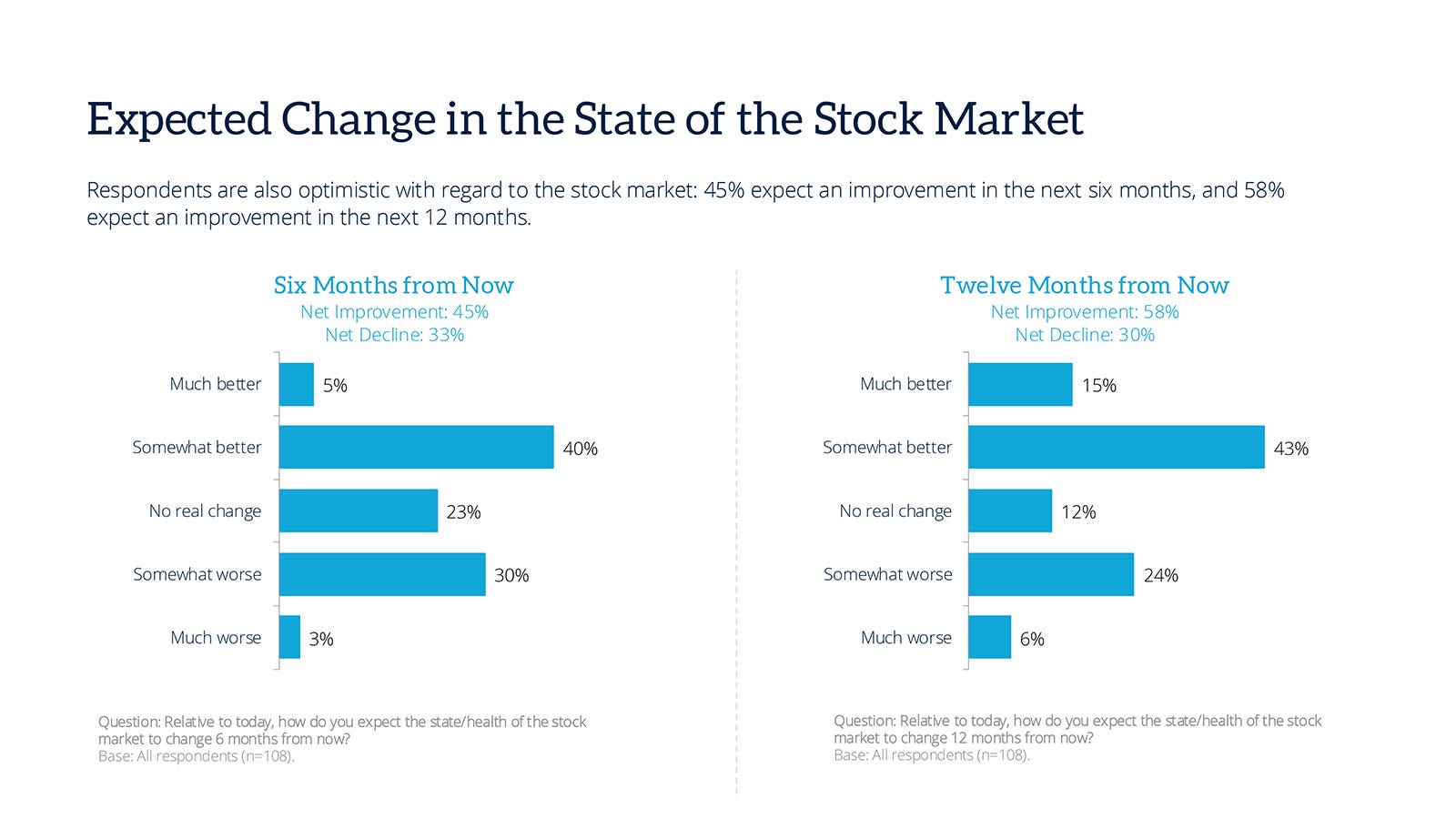

Optimism was somewhat tempted when their view of the stock market was asked over the next six months: 45% expect an improvement, while 33% expect a decline. This short -term ambivalence returns when you look at 12 months: 58% expect an improved stock market.

While corporate revenue is expected to exceed expectations in 2025, there is a concern that the stock market be overestimated, especially in certain sectors such as technology, and the concentration of profits in some large companies.

Many advisers provide for short -term instability, with some predicting a market correction due to high estimates, geopolitical tensions and uncertainty about government policies. However, there is a fundamental optimism about long -term market recovery.

The councilors' feeling about the current state of the economy is also raised to 117, falling only a little from December, the 12-month high index.

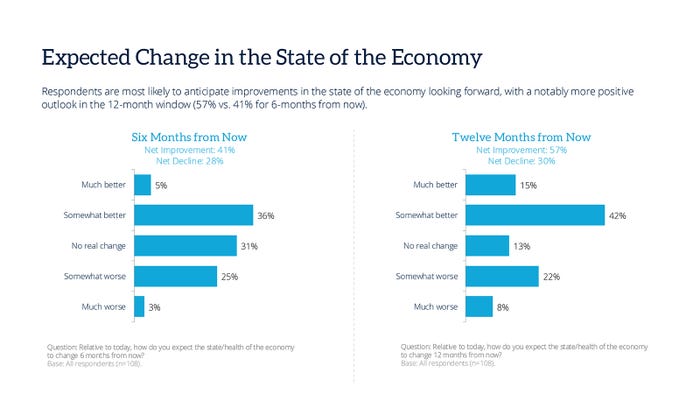

When asked about their feelings for the economy over the next six months, less than half of councilors, 41%, expect improvements, with 28% seeing a decline. This increase in pessimism returns when looking further in the future, with 57% waiting for improvement.

Inflation and increased interest rates remain major concerns. Some expect inflation to continue, while others predict gradual relief with possible decrease in the nourished rate. There are also concerns about high levels of debt and economic slowdowns.

Methodology, data collection and analysis from wealthmanagement.com and WBB bra and Information Engage. The methodology matches the accepted methods, practices and procedures of marketing research. Starting in January 2024, Wealthmanagement.com began promoting a short monthly study for active users. The data will be collected within the last ten days of each month that goes ahead, for the purpose of at least 100 respondents of financial advisers per month. Respondents are required their opinion on the economy and stock markets both currently, in six months and in one year. Answers are weighed and used to create a neutral value index of 100. Over time, it will ensure the directed feeling of retail financial advisers.