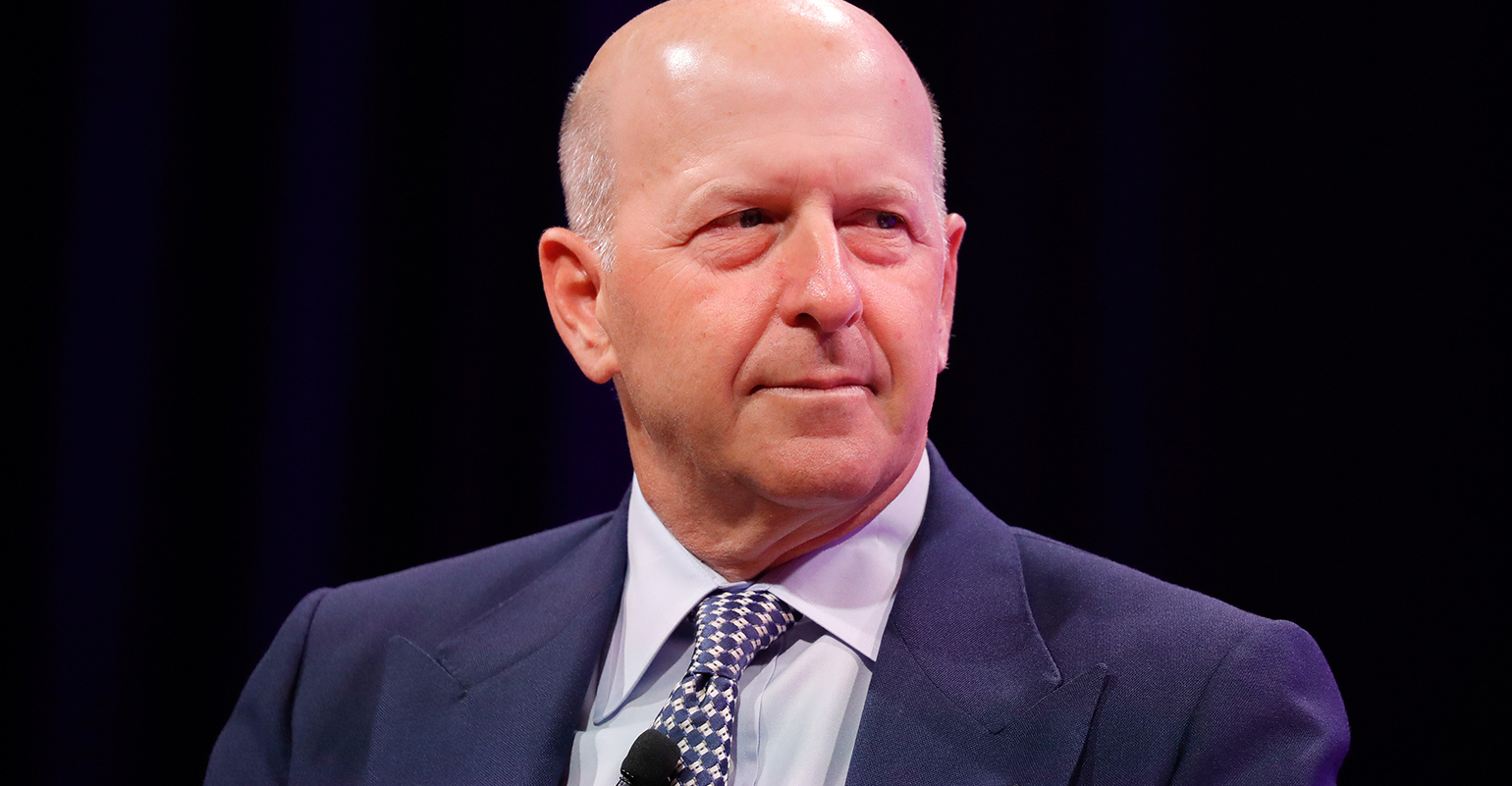

(Bloomberg) — Goldman Sachs Group Inc . boosted David Solomon's compensation by 24% to $31 million for a year when revenue fell at the Wall Street giant.

The board raised the chief executive's pay as profit fell 24% and the firm spent much of the year plugging internal fissures and nudging investors on a streamlined strategy. After giving up its retail banking ambitions, New York-based Goldman has returned its focus to the lines of business embraced by Solomon's predecessors.

The package for the 62-year-old banker includes a base salary of $2 million and $29 million in variable compensation, with $20.3 million of that in the form of restricted stock units, according to a regulatory filing. His pay rise was larger than any other major US bank CEO whose compensation has been disclosed.

Unlike last year, the salary announcement came after the conclusion of an annual meeting of the firm's top executives in Florida.

Goldman shares advanced 12% in 2023, ranking it fourth among the six largest US banks. The firm started the year from starting out one of the largest rounds of job cuts ever, eliminating about 3,200 jobs.

The bank was hurt last year by stalled capital markets that kept a lid on inflated fees and losses in real estate investments, as well as its failed consumer strategy. That resulted in Goldman posting just $8.52 billion in net income for the year, well below the pace of recent years.

Goldman's compensation committee cited Solomon's “decisive leadership in recognizing the need to clarify and simplify the firm's future strategy,” according to the filing. While this “adversely impacted near-term performance,” the actions “were critical to reorienting the firm with a much stronger platform for 2024 and beyond.”

Solomon's salary for 2022 was reduced about 30% after an even greater drop in profit that year.

While the bank still claims three divisions in its results, it has shied away from what it calls its “platform solutions” business and has directed investors to focus on its investment bank and money management business. These two groups accounted for about 95% of Goldman's Income last year.

Last month, JPMorgan Chase & Co. said this CLUE Longtime CEO Jamie Dimon $36 million for last year, up 4.3% from a year earlier. Morgan Stanley raised James Gorman's pay by 17% to $37 million for his final year as CEO.

Read more: Morgan Stanley paid Gorman $37 million for his final year as CEO