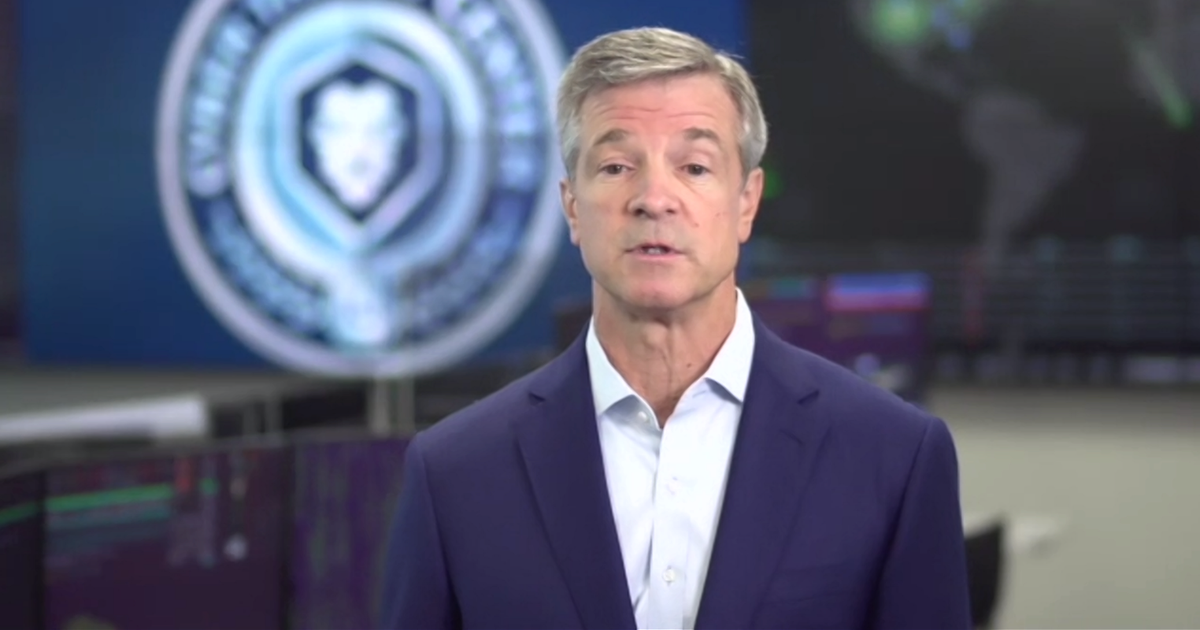

Operation leader Raymond James Scott Curtis is the new head of the Board of Finra Governors, following the outgoing chair and CEO FUSIONIQ ERIC NOLL.

The Board of Finra governors chose Curtis as his next chair during his meeting last week. The Board also reviewed changes in residence rules over the supervision of reps' firms outside the activities of the external business.

Curtis had already served as a governor and a major representative of the firm since 2023. According to Finra, Noll was withdrawing to get a job that would “run counter to his role” as a public governor.

“I am excited to continue to build the work ERIC has run in providing strategic guidelines for the essential role of finishing for investor protection and maintaining the integrity of capital markets,” Curtis said.

Curtis has been with Raymond James since 2003 and headed its domestic property management business as the leader of his group of private clients since 2018 before being promoted in COO in 2024.

His height was part of the firm's success planwhich restructured its executive suite. The plan included the announcement that the then CFO Paul Shoukry would follow Paul Reilly Si CEO, becoming the fourth person who led the firm in its history (Shoukry took over the role Effective February 20). Elwyn followed Curtis in the direction of the firm's private client group.

The Board of Finro Governors oversees the management of the organization. It consists of 10 countries for industry members and 11 for “public members” who must have “no business material relationships” with a mediator/trade or a self-regulating organization to qualify.

Seven industry countries correspond to the size of the firm. The governors serve three -year conditions (and cannot serve more than two consecutive terms), and the board meets at least four times a year.

During the meeting, the Board was informed of efforts to modernize the technology used by its exam staff. He also approved a notice to request public comment on the revised rules on foreign business activities. The new rule would replace two existing regulations with a single rule to “reduce unnecessary compliance loads” for firms reviewing external business activities.

Finra continues to face court cases across the country, challenging its constitutionality, following some decisions taken last year by an ideologically reconstructed supreme court.

In one case, Alpine securities are asking the US Supreme Court Consider listening to her issue for years against finra, potentially placing a showdown that can damage the brokerage regulator and other self-regulating organizations like it.