Advisory technology provider Nitrogen — formerly Riskalyze — unveiled a series of platform and tool updates at its annual Fearless Investing Summit held this week in Nashville.

“We want to be your platform of trust,” said CEO Dan Zitting, who took over for Nitrogen founder Aaron Klein last November.

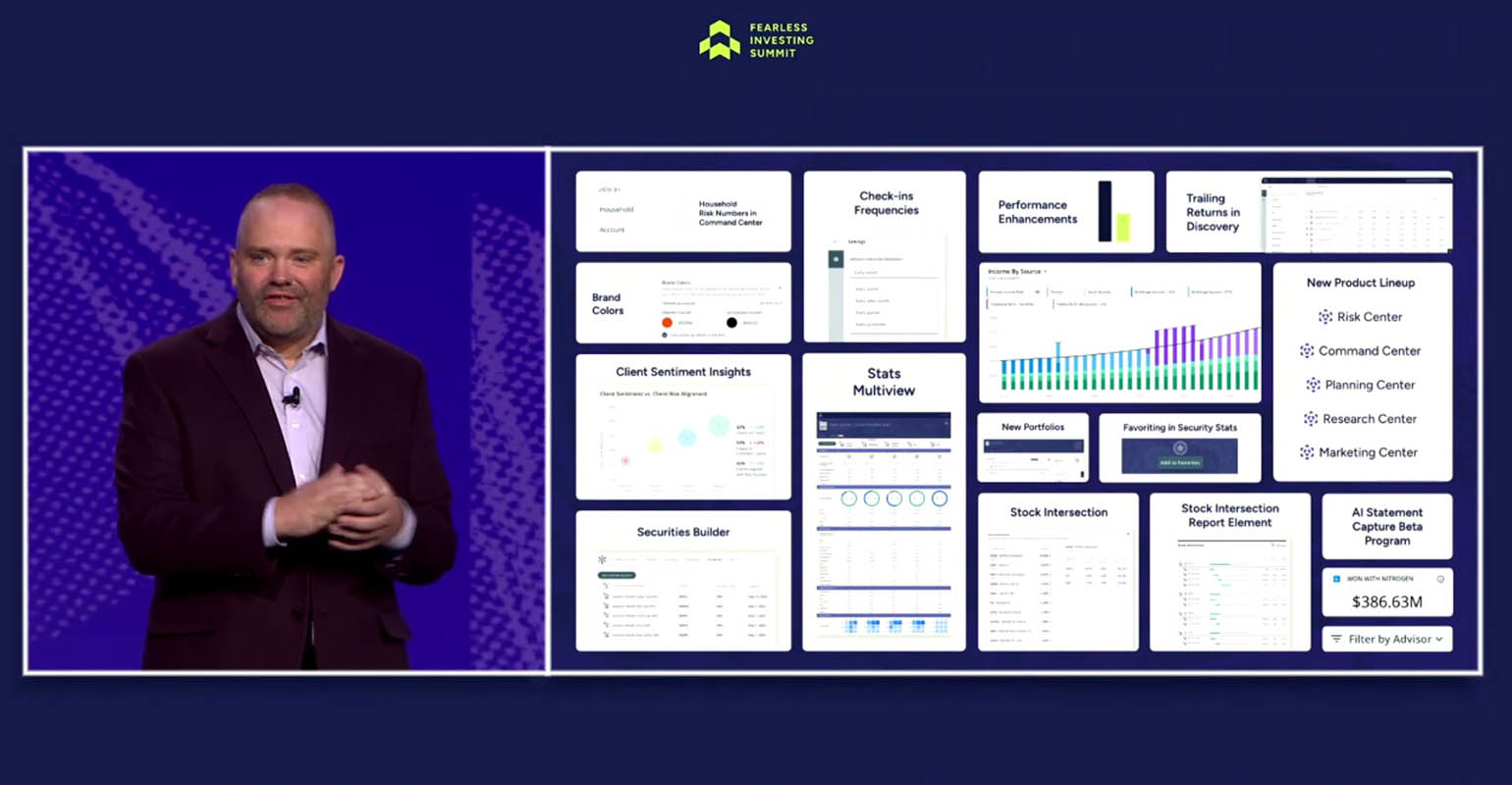

Chief Product Officer Justin Boatman introduced several enhancements, including expanding oversight and controls within the Nitrogen Command Center in 2024 to include new tools like Advisor Filters, Subdomains and the Securities Builder, which give enterprise firms better access and customization options.

Boatman also discussed a new framework that allows firms to “distribute the big package.” Now, advisory shops using the platform, which range in size from sole practitioners to multi-billion AUM firms with hundreds of advisors, can purchase individual components or complete packages of the entire suite (Elite packages), according to Nitrogen. Price was not discussed.

He said that enterprises can now build their best technology group, access the products they need and price according to the volume of accounts in their data feed, and also have advisers and assistants unlimited access to the system.

Boatman also introduced the Stock Intersection tool, which allows advisors to break down equity exposures within funds and portfolios.

“The No. 1 feature requested by advisors here at Nitrogen has been the ability to illustrate the underlying equity exposure to tell a more complete story about a portfolio,” he said, illustrating the feature with hypothetical client Andrew, who comes asking about Nvidia and says, 'I think now is the right time to buy it.'

“We easily show him that it's already 9% of his stock by clicking on 'Cross Stocks,'” Boatman said.

These illustrations, in combination with the ability to display in-depth comparisons of up to five portfolios and investments side-by-side called Stats Multiview, were some of the new features demonstrated.

Other releases within the Research Center included improved tools for analyzing trailing returns in Discovery, Nitrogen's fund tracker and the ability to 'favorite' securities for creating more efficient propositions.

Stock Intersection and other features are available immediately, while Stats Multiview will be available sometime in November.

The company's single most popular toolset — Risk Center — is also getting updates, said Nick Harding, Nitrogen's head of customer success. He introduced AI Statement Capture, a new tool in beta available to current Nitrogen customers that streamlines the conversion of customer statements into actionable portfolios.

Stephanie Walker, managing director of Advisor Solutions, discussed updates to the Planning Center and introduced Income Source, a retirement income planning feature that provides full visibility into clients' decumulation strategies and reports on their income sources .

“It allows clients to see where their retirement income will come from,” said Walker, who illustrated how easily advisers can demonstrate to clients the dynamics of how that income will change over time.