Friday, the US Bureau of Labor Statistics released a long-awaited employment report that can be one of the most important this year's economic news. The report provides a picture of employment that will be crucial to interest rate decisions taken by the Federal Reserve at its September 18 meeting. later this month.

Economists had expected US employers to add 20,000 more jobs in August than reported. Meanwhile, there are now 800,000 unemployed more than a year ago.

Wall Street is expected 160,000 new jobs added to the market in August, with some analysts predicting 163,000 new jobs. The number tracked by the BLS report was lower than those expectations, at 142,000 jobs. Construction and healthcare were the two fields that added the most roles, with 34,000 and 31,000 open positions in those two fields, respectively.

The unemployment rate is now 4.2%, higher than the 3.8% it was at the same time last year, but lower than July's 4.3% jobless rate, which was the highest as of October 2021. The number of unemployed went from 6.3 million to 7.1 million from August 2023 to last month, an increase of 800,000.

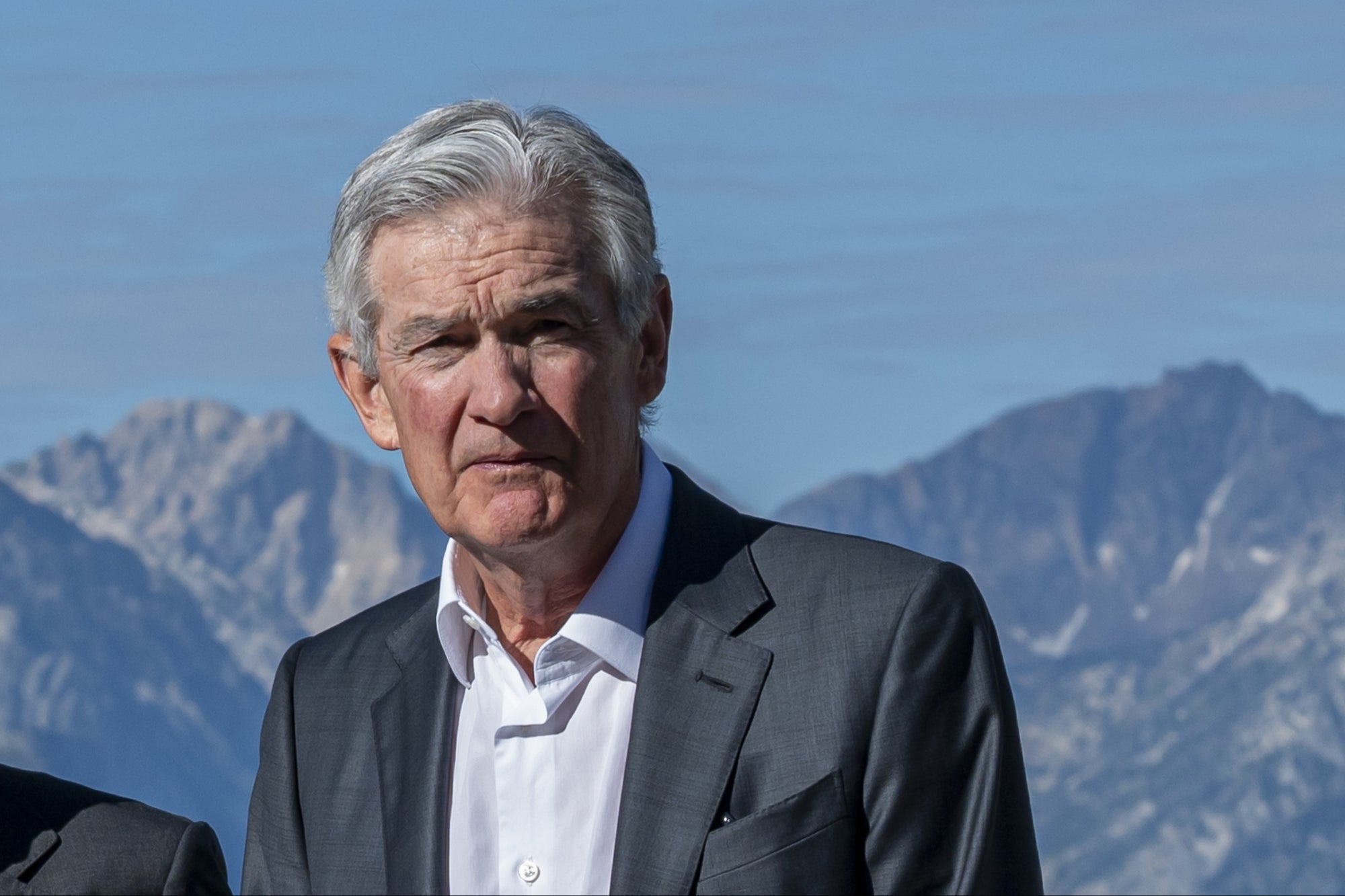

Federal Reserve Chairman Jerome Powell. Credit: David Paul Morris/Bloomberg via Getty Images

Federal Reserve Chairman Jerome Powell. Credit: David Paul Morris/Bloomberg via Getty Images

Related: CPI report: Inflation hits 3-year low, analysts predict Fed will cut rates next month

The average private sector worker saw hourly wages increase 14 cents from July to August, to an average of $35.21 an hour.

The report “confirmed that the labor market did not fall off a cliff,” said EY senior economist Lydia Boussour. entrepreneuradding that “consensus is likely to lean towards a methodical 25bps (0.25%) rate cut on September 18 and a steady pace of easing thereafter.”

The BLS also significantly revised up its payroll numbers by 818,000 jobs from April 2023 to March 2024, the largest revision by the bureau. since 2009. The review shows “a material softening in employment,” Boussour said.

In one speech last month in Jackson Hole, WyomingFederal Reserve Chairman Jerome Powell said “the time has come for policy to adjust” to a cooling job market, indicating the Fed was considering lowering the federal funds rate. That rate, in turn, affects interest rates on everything from credit cards to mortgages.

Related: Fears of a US recession are 'overstated', according to EY's chief economist. Here's why.