With football season fast approaching and the estate tax exemption ending, I thought it would be a good time to get back to basics. I bring this up because we have less than 16 months before the generous estate tax exemption limits expire at the end of 2025. Clients who haven't started planning their estates are doing a two-minute exercise. When the pressure is on and the clock is ticking against you, it's tempting to look for short-cuts of faith and the various charitable giving schemes that have emerged in recent times to cash in on a fortune. Don't get out of the game. If the strategies seem too good to be true, they probably are.

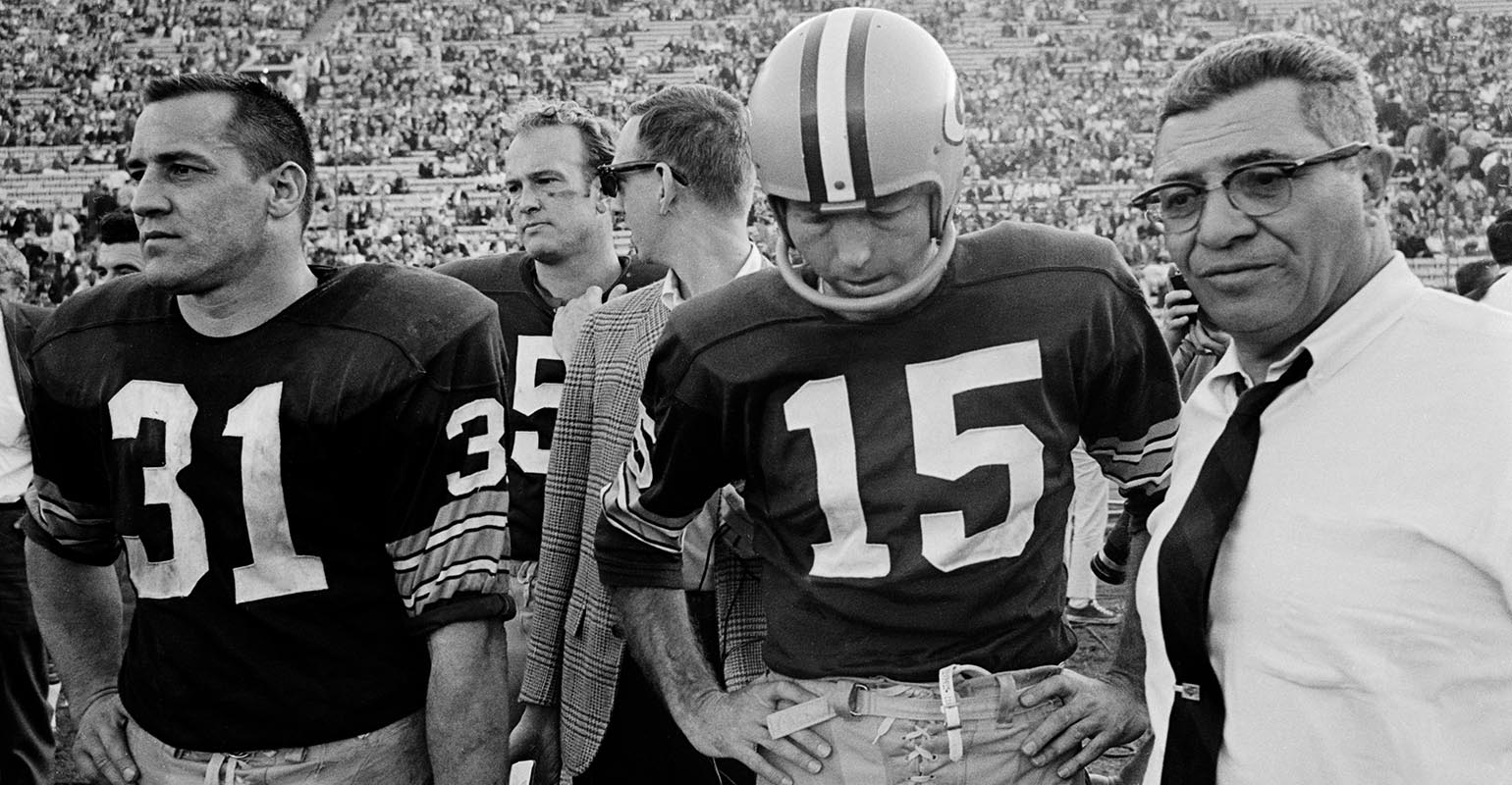

Now more than ever, stick with basic, proven strategies. Because if you have to release a broken bequest or a hastily collected gift, it can be much more expensive to fix and requires some nasty run-ins with the IRS. Hall of Fame football coach Vince Lombardi once said: “I don't care about (fancy) formations or new attacks or defensive tricks. If you block and tackle better than the team, you're going to win.”

Regardless of which party inherits the White House, we don't know if any of the proposed legislation will pass. Rest assured, the exemption limits will most likely be reduced and not increased. If you don't help your clients take advantage of the historically generous estate tax exemption limit before it changes, you could be missing out on a once-in-a-lifetime opportunity. Your clients may never have another chance to get so much money from their estate tax-free.

Bona fide craftsmen can make plans as flexible as possible. They are adept at extracting assets from your clients' taxable estates through charitable giving, while still protecting clients and allowing them to access their assets. However, a well-designed plan doesn't happen overnight, and every good estate planner I know depends on their eye at work. Don't wait until the last minute.

SLAT

The Spousal Lifetime Access Trust (SLAT) is one of the most popular trust structures today. Essentially, a SLAT is a legal agreement designed to help individuals transfer their assets from their estate by providing spousal access. When you create a SLAT for your spouse's benefit, you can gift assets up to your lifetime gift exclusion—currently $12.92 million per individual– without paying federal estate taxes. Transferring these assets out of your direct ownership allows your spouse and beneficiaries to benefit from future appreciation. As long as the couple remains married, these assets can continue to support their lifestyle, even though they have received the principal amount of the gift (and future growth) from their estate.

SLATS are fairly new, having appeared half a dozen years ago. Before SLATs came along, we used a similar structure called “defective trusts” which allowed you to take assets out of your estate. But with impaired trusts, there was no provision for your client's spouse to have access to those assets. SLATS are a smart new twist. However, there are some drawbacks to SLAT:

- Lack of flexibility: Gifts to a SLAT are final and cannot be undone. However, we may add provisions that make irrevocable trusts revocable if necessary.

- Lack of control: As the grantor spouse, your client must relinquish direct control and access to the trust assets. Since they cannot be a trustee, they will have no say in whether and when distributions are made to beneficiaries. Many couples who consider SLAT planning eventually decide that they are not comfortable losing so much control over their assets.

- Risk of divorce: If your client divorces, they will lose the indirect access to the SLAT funds they had through their spouse and the ex-spouse will continue to benefit from the trust.

- Loss of access if spouse passes: On the death of the non-donor spouse, the donor will lose indirect access to the SLAT.

So don't turn your back on flawed core beliefs if SLATs aren't the ideal solution for a client. Also, if your client transfers money, business interests or real estate to a SLAT, the assets must be transferred at fair market value as determined by a qualified, independent appraiser. As with estate lawyers, appraisers are extremely reserved now. Don't skimp here. That could draw a penalty flag from the IRS, which has more strictly scrutinized large transfers to trusts and questioned fair market values.

Beware of emerging estate planning schemes

As time runs out west of the wealth tax exemption limit, I imagine we'll see increasingly hastily assembled beliefs and strategies that are, frankly, weak. It's amazing what people will do in the interest of potentially saving tax, but in the process, they lack basic grip and handling.

I've seen four or five in the last month that have left me scratching my head. For example, there is a yacht brokerage website where you can supposedly use your yacht (or plane), get a tax write-off, and then give your yacht or plane to charity. It claims to be sanctioned by the IRS and eliminates hobby loss rules. The seven-page letter on the website is full of legalese and marketing jargon without saying anything, and they tell charities they have valuable assets to give away. Again, if it sounds too good to be true… you know the rest.

Meanwhile, I've heard of a group that sells mineral rights that claims you can earn a tax deduction worth eight times your initial investment (ie, a $400,000 income tax deduction for a $50,000 investment ). That's because it has a complicated charitable giving attached to it. In theory, you are buying the minerals at the low cost of getting them out of the ground and giving them away at their marked retail price. There is no economic reason to do this type of transaction other than to save tax – and the government doesn't like anything you do just for tax reasons. And when you look at the attorney opinions attached to these charitable mineral law schemes, they are often written by law firms that don't exist or by personal injury attorneys with no estate planning credentials. Sounds like an “illegal procedure” penalty flag to me.

Finally, a prominent attorney tells high net worth individuals that they can put appreciated assets into a special type of trust before selling them. He claims the trust allows them to defer profit to the sale because it uses installment sale rules to keep them from receiving the funds. But you can never make money when looking at promoter fees and money management costs. Flag!

These are the types of controversial schemes that may gain more traction with HNW individuals and their advisers, with the clock ticking against them. So it makes me wonder, why not just do basic blocking and handling?

Randy A. Fox, CFP, AEPis the founder ofTwo Hawks Family Office Services. He is a renowned wealth strategist, philanthropic estate planner, educator and speaker.