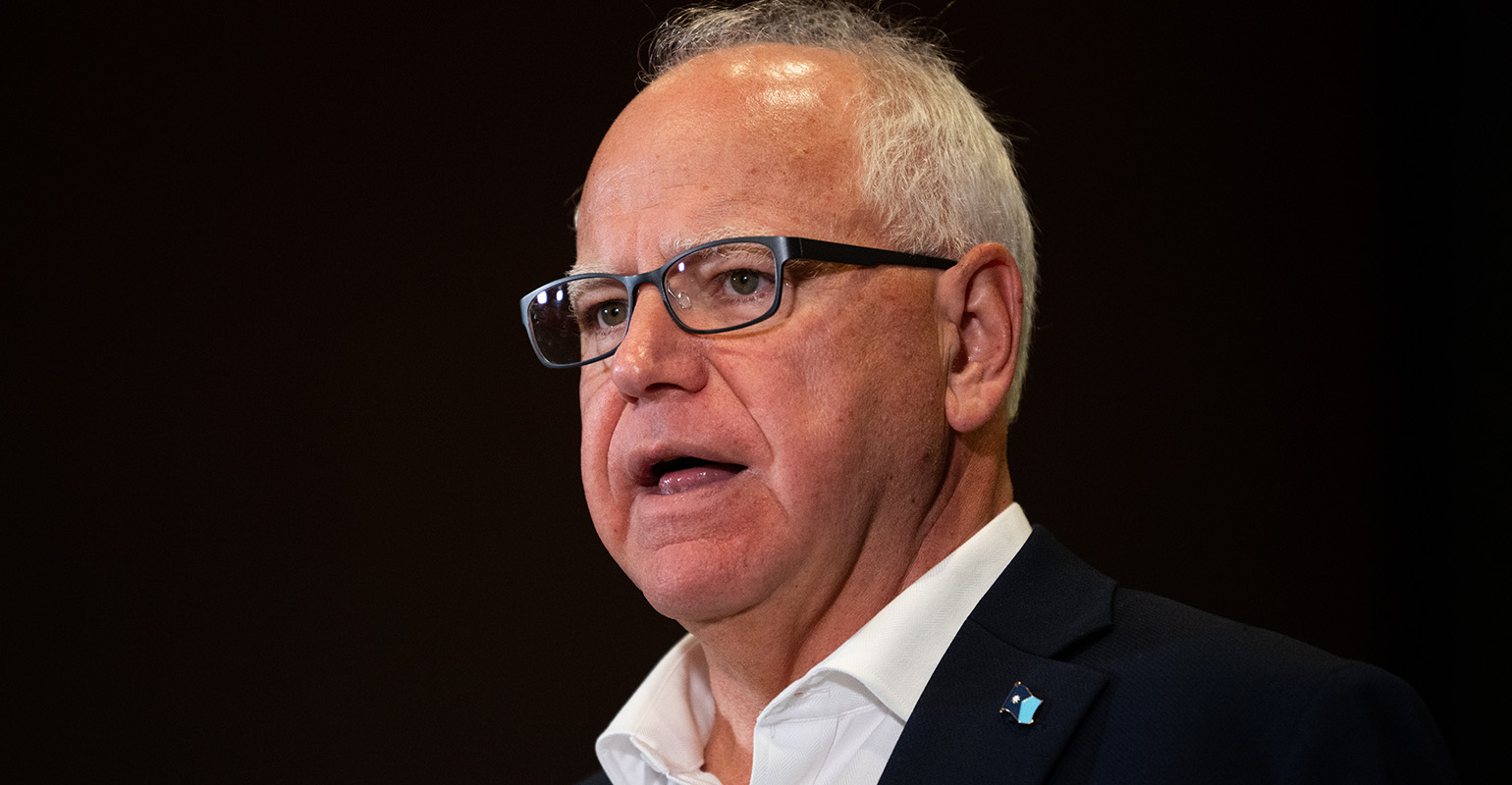

(Bloomberg Opinion) – The great divide in America is not so much between Republicans and Democrats as between people who invest and those who don't. For a man of his means running for the second highest office in America, Tim Walz is on the wrong side.

In 2022, 58% of Americans owned stocksdirectly or indirectly through mutual funds. Based on his 2019 financial disclosures and his 2022 tax filings, the Democratic vice presidential nominee is not one of them. His files provide no evidence ownership of assets – no stocks, no bonds, no mutual funds, not even his house (he sold it a few years ago, after becoming governor of Minnesota) – except for a small college savings plan whose investment allocation did not it is known.

This can strengthen his neat image. But more Americans than ever are now on the market – 58% up from 32% in 1989 – and not being on the market is no longer a common virtue, or any virtue at all. Investing in the stock market should be a fundamental part of any balanced portfolio and retirement strategy, and not investing can suggest a lack of understanding of risk management and financial literacy – especially if you have some money to invest, which Walz does.

Neither the vice president nor the president should be Warren Buffett. In fact, it would be better if politicians did not have individual shares at all, because of the conflicts of interest that could arise. But someone who sticks with index funds is still an investor, and being an investor signals some important qualities that the US should expect from its leaders.

The main reason for Walz's lack of a portfolio is that he is less wealthy than the average politician. His family is estimated to be between $119,000 and $330,000. A life of public service and politics doesn't pay well unless you can complement it with lobbying, speaking engagements and lucrative book deals – none of which he took part in.

This is admirable. But Walz is not poor; The median net worth in America in 2022 was $190,000, and among households with a net worth between $100,000 and $300,000, 59% owned some stock — 25% of them outside of their retirement accounts. Walz has a 529 college savings plan worth between $1,000 and $15,000. He also at least had access to the 401(k)-type account, but it's unclear if he participated; His tax filings do not reflect what is in these accounts and there may be some stock in there.

However, it is a little strange that he has no assets in any other account. After all, in many ways he is well positioned to invest in the markets.

Walz and his wife have accumulated a defined benefit pension valued at about $800,000. it it could be argued that, since Minnesota's public pensions are invested in stocks (and surprisingly high amount in private capital), he has an exposure to stocks. But it's not stock exposure in any meaningful way, because the state of Minnesota guarantees the pension for life. His net worth doesn't change with the stock market, except for maybe a few thousand dollars in that 529 plan. He's actually a lot richer than he looks on paper because that $800,000 is risk-free.

This would be another good reason, from a financial point of view, to invest in the market – it has a very large level of income that is guaranteed by the government. He also claims to have a life insurance policy as an asset, which suggests more downside protection and a willingness to pay high premiums to avoid risk.

Everyone is entitled to their own investment preferences. Maybe Walz is just extremely risk-averse. Or maybe, like many Americans, he is not as financially literate as he would like to be and does not understand the benefits of investing in the stock market: diversification and the opportunity to profit from the growth of the American economy.

Either way, it begs the question: Is this what America wants from its leaders? They must be able to tolerate some risk. And taking a long position in the stock market is making an optimistic bet on the future of the US economy.

Walz's investment strategy contrasts sharply with that of his Republican rival JD Vance, who is worth millions but has also made some curious choices. He has up to $250,000, a not insignificant portion of his $4.2 million fortune, in Bitcoin. This investment can be interpreted as a bet against the stability of the dollar, which also suggests something less than full confidence in the US economy.

The willingness to take a balanced risk is an admirable quality in a leader. So is a sophisticated understanding of global markets. Avoiding the stock market can be seen as a normal credential, but it can also be a sign of being overly cautious. America's leaders certainly don't need to be rich or big investors, but they do need to have some engagement with the markets. Not having any investment is not in itself a reason not to vote for someone – there are far more important issues and all candidates have their quirks. But it's kind of weird.

Elsewhere in Bloomberg Opinion:

Want more? Subscribe in our newsletter.

To contact the author of this story:

Allison Schrager at (email protected)