(Bloomberg) — The booming private loan market is a growing concern for the top enforcement official at the U.S. Securities and Exchange Commission.

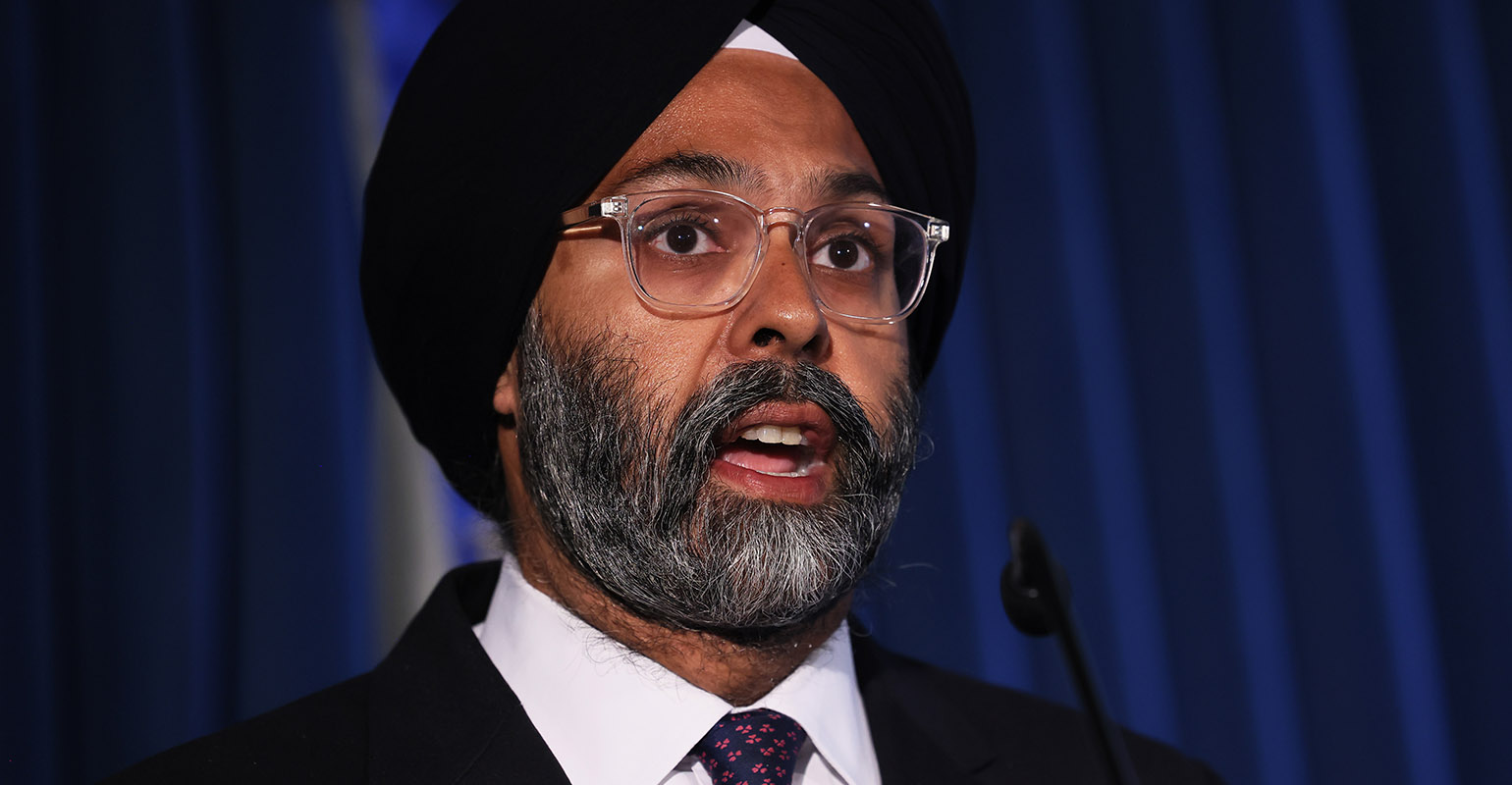

During a wide-ranging interview this week, Gurbir Grewal said he sees a number of potential risks to the $1.7 trillion private lending industry. The enforcement chief signaled that everything from market concentration to the way assets are valued will face more scrutiny.

“I'm concerned about the valuation issues: how are these investments being valued because they're illiquid,” Grewal said. “I'm concerned about — as we would be with other private funds — fee and expense issues, and conflict of interest issues.”

The SEC hasn't brought many enforcement actions on private lending, and Grewal didn't name any specific firms or deals that drew regulatory attention. However, his comments serve as a warning as some of the biggest names in finance increase their involvement.

Although private lending has been around for decades, it has taken off since the 2008 financial crisis, when banks scaled back their business lending in line with tighter regulations. Firms such as Blackstone Inc., Ares Management Corp. and Apollo Global Management Inc. have filled the credit gap left by the banks, providing financing for businesses.

Growth in the industry has accelerated in recent years, from just over $1 trillion in 2020. Pension funds, endowments and insurance companies flooded private loan managers with so much capital that they don't have enough deals to invest it.

Grewal said he understands the allure for investors.

“Performance has been where it's been,” he said. “And these entities can be less leveraged and their loss rates can be much lower. So there are positives. I think what we have to do from our perspective is make sure that people don't abuse the lack of transparency.”

Rapid Growth

US regulators have not said the industry's rapid growth represents an immediate threat to financial stability. However, they have been asking for further review for months.

In February, Michael Hsu, the acting comptroller of the currency, said officials should keep track of risks from private equity firms that come from more lending and ramp up other activities typically done by banks.

Read more: Pushing private PE credit could pose stability risk, says OCC's Hsu

Private payday loans are usually held by the funds that made them until they are repaid – and are rated at markups influenced by the manager also. This may be attractive to investors because assets are no longer subject to sudden price fluctuations, but it has also increased concerns about ratings.

Read more: The Private Lending Code of Silence is hiding market flaws

Meanwhile, private equity funds face far fewer regulatory burdens than publicly traded companies and banks. The SEC regulates them as advisers to private funds, which have limited disclosure requirements and often broad investment discretion.

Under Chairman Gary Gensler, the SEC has tried to bring greater scrutiny to private funds, which include hedge funds and private equity firms. However, earlier this month an appeals court blocked new rules that would have forced firms to detail their quarterly fees and disclose more about their expenses. The SEC is currently weighing its response to the decision.

bids

- Blackstone Inc., KKR & Co. and Antares Capital are among the firms that participated in a $1.4 billion financing for DuBois Chemicals to refinance existing debt

- Private equity firms looking to buy French software company Orisha are planning to use a loan from several private credit lenders to finance the acquisition

- Carlyle Group Inc. and Goldman Sachs Private Credit have offered one $1.1 billion bill in kind to finance Apex Group administrator

- Bankers from Jefferies Financial Group Inc. have been looking for investors, including private lending firmsin connection with an agreement to provide new capital to low-cost gym operator EoS Fitness Holdings LLC

- Hong Kong fintech company FundPark has received a three-year term $250 million in private loans with HSBC Holdings Plc as the senior facility provider, the second such investment the firm has secured this year

- Lazard Inc. is weighing several options for it get a private credit firm that would help expand its $250 billion asset management arm, becoming the latest Wall Street bank to look to enter the buzzing sector

- Apax Partners' acquisition of software provider Zellis has been backed with a unique £450m facility led by SMBC Group and Park Square Capital

Fundraising

- HPS Investment Partners raised $21.1 billion in investment capital through the final closing of its Specialized Direct Lending Fund VI

- BlackRock Inc. is expanding further investment in private marketsstriking a new partnership to include assets alongside traditional ETFs and mutual funds in model portfolios offered to affluent US retail clients

Labor movements

- Blue Owl Capital Inc. has hired four executives in Europe as part of an effort to raise money from the region's institutions

- Coller Capital has hired Roman Eggler as head of private wealth distribution for Germany, Austria and Switzerland

- Orix Corporation USA has hired Nik Singhal as head of the direct lending group as part of a wider restructuring, the firm is undertaking to attract more external capital

- Glen Lim, Brian Stern and Daniel Tola – finance attorneys specializing in private loan transactions – have joined O'Melveny's Los Angeles and Century City offices as partners in the corporate finance practice