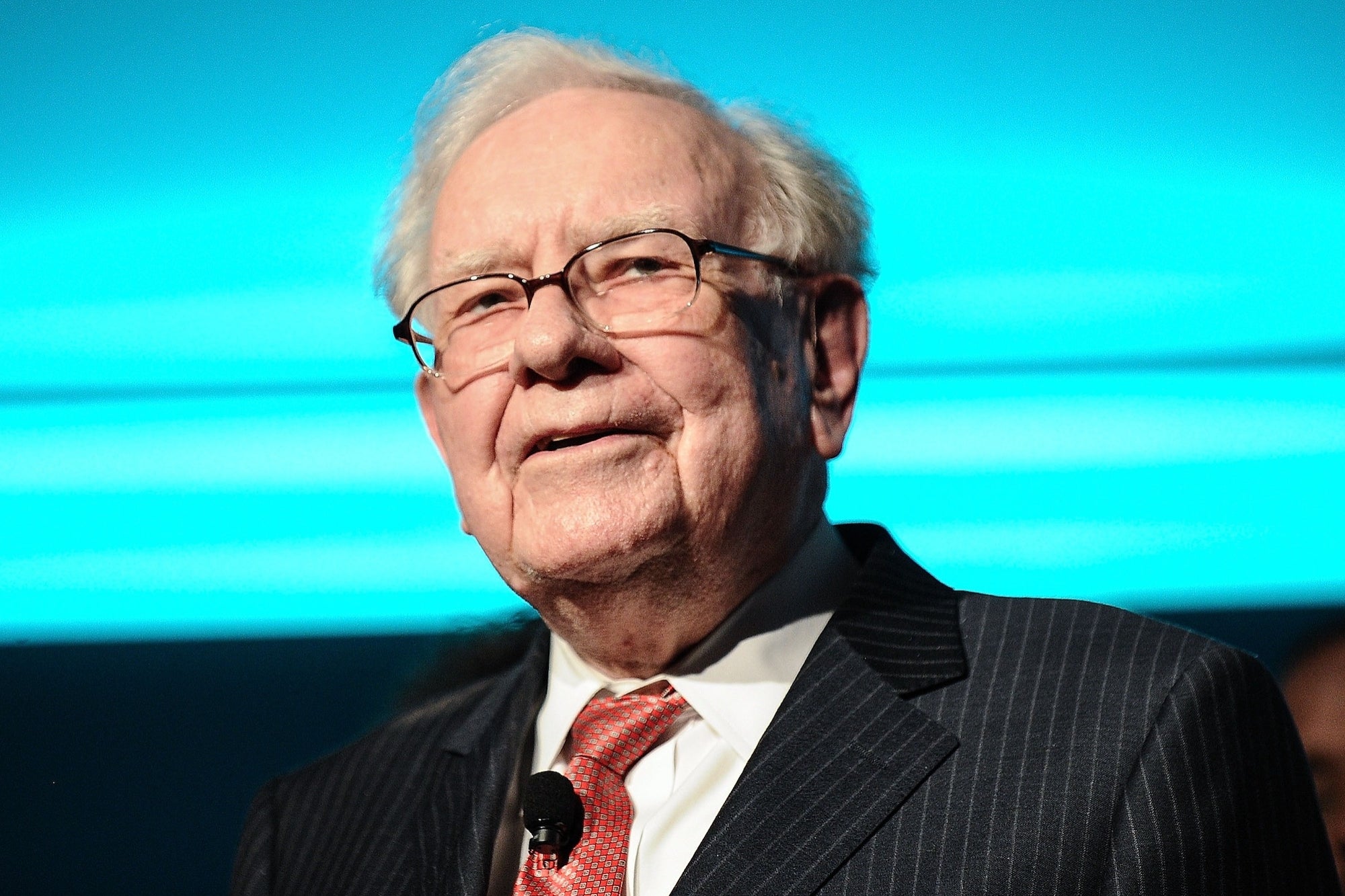

Warren Buffett's Berkshire Hathaway has mysteriously invested millions of dollars in an anonymous company over two quarters. — but now, thanks to a new filing with the US Securities and Exchange Commission, the mystery has been solved.

A Wednesday PRESENTATION revealed that Berkshire has bought 26 million shares of insurance company Chubb, a stake valued at $6.7 billion.

The Swiss insurance giant was won from Ace Limited for $29.5 billion in 2016, combining the two companies under the Chubb name.

Chubb had an exceptionally strong first quarter of 2024, with net income up 13.3% to $2.14 billion and core operating income up 20.3% to $2.22 billion.

“We started the year with a simply excellent quarter,” Chubb CEO Evan G. Greenberg said in a statement release of earnings. “We produced double-digit premium revenue growth from around the world with strong results in our commercial and consumer P&C and Asian businesses.”

The investment has been kept under wraps for two quarters after Berkshire Hathaway was granted special permission to do so, something the company has done before after buying stakes in Chevron and Verizon in 2020.

This isn't Berkshire's first major investment in insurance — the conglomerate owns 100% of Geico, National Indemnity and General Re.

Earlier this month, Berkshire Hathaway held its annual shareholder meeting in Omaha, Nebraska, where Buffett revealed that the company had unloaded its entire stake in Paramount at a loss.

Connected: Warren Buffett learned a lot about his iPhone this week

“I was 100% responsible for Paramount's decision,” Buffett he told the audience in that time. “It was 100% my decision, and we sold them all, and we lost a lot of money. That happens in this business.”

Apparently, thanks to Buffett's Chubb seal of approval it was upstairs 4.3% in a 24-hour period and over 32% in a one-year period as of Thursday morning.