2024 has marked a pivot of economic conditions that investors should keep in mind.

Over the past two years, we've seen rampant inflation, rapid rate hikes, negative real rates, an income recession, tight corporate balance sheets as wages rose, and a recession that never appeared.

What has changed? We observe stronger economic growth, positive real rates, possible rate cuts and a possible change in market leadership.

These two environments require two very different portfolios. Astoria is now more constructive to start 2024 than we have been in the last two years. We entered this year overweight stocks, especially US stocks. We continue to rely on quality (QUAL, DGRW, etc.).

We believe the expansion of the market will continue and eventually become more powerful. Astoria believes risk management by moving away from highly concentrated passive funds is prudent. That doesn't mean we don't own them; however, the concentration continues to increase, which worries us. in diverse risk in our portfolios by allocating 1/3 to equity weight, 1/3 to market cap weight and 1/3 to quantitative/smart beta.

INTERNATIONALLY, we are constructive for Japan. We see strong earnings revisions, high growth estimates, strong price momentum, relatively cheap valuations, attractive EPS growth, GDP growth potential and improved corporate financials. DXJ is an ETF that expresses this view.

Regarding fixed income this year, we are shaking up corporates, munis and Treasuries. Astoria is duration neutral against the standard. We have also started buying MBS (SPMB). We have reduced our exposure to negatively correlated alternatives such as BTAL. We continue to use our rate sensitive / real assets and gold (GLDM) strategy in our portfolios.

Top ETF Picks:

- DXJ: Strong earnings reviews and price momentum, high growth estimates and attractive valuation.

- QGRO: Has performed impressively without taking extreme risk of concentration in Mag 7. The largest holding is Booking Holdings (3.09%). Only 3 Mag 7 stocks in its top 10 holdings account for 8.09% (As of March 11, 2024)

- SPMB: Agency MBS have higher spreads than corporates, their YTM is attractive and default risk is low.

Astoria's High Quality Strategy

Along with our top 2024 investment picks is our high-quality US equity strategy. Since 2020, we have used this strategy. The strategy quantitatively selects the highest quality stocks within each sector, using sector-specific quality metrics. It is equally weighted AND sector optimized for the broad US large/midcap market. This is an important point because an equal-weight broad market index like the equal-weight S&P 500 assigns equal weight to all stocks, ending up with ~16% technology exposure. Astoria's quality strategy, on the other hand, leveraging sector optimization, has ~31% technology exposure (as of March 11, 2024).

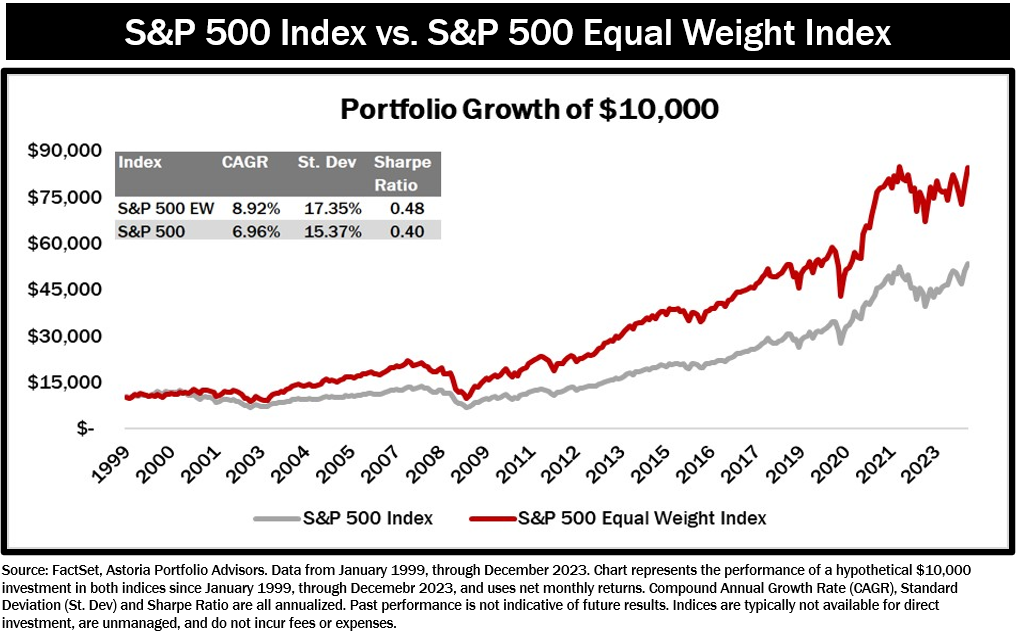

Why is it of equal weight? Over time, the SPXEW has outperformed the SPX (weighted by market cap). Since 1999, the SPXEW has outperformed the SPX with 310% cumulative returns and 1.96% annualized returns. See the chart below.

Why quality? Research shows that the quality factor has a higher return/risk over time than other factors.

Astoria is a strategic investor. We use the equal-weight quality strategy as a long-term portfolio allocation. It complements our growth allocation and diversifies our market cap weighted core equity positions.

Astoria's take on ETF trends

Bitcoin is grabbing all the headlines. We are bullish on the asset class but need to wait for a pullback before entering our alternatives allocation.

We believe that equal weighting is a crucial diversifier. As mentioned, we are implementing it with market cap weighting and quant/smart beta (1/3 each).

Corporate spreads are very tight, and penultimate rates remain stubbornly high; this must change before the crowds leave money markets and Treasuries.

Fixed income has received massive inflows YTD. This is strange since AGG is down 0.51% and SPY is up 7.57% since March 11, 2024.

Broader inflows into stocks depend on economic data and Fed decisions. We have received many questions about small caps and value. We will need to see rates come down before we allocate to smaller caps in our portfolios.

If economic strength continues, this will keep rates where they are; value, small cap and overwriting will struggle while quality, growth and market cap weight will remain attractive. QUAL had significant upside in 2023, returning 30.88% calendar year and +10.80% YTD as of March 11, 2024.

China's deflationary issues will cause DM exporter-driven countries to suffer. We expect US inflows to continue.

The “year of EM” was predicted, going to 2024, but it has not yet been seen. YTD to March 11, 2024, KWEB -4.81% and EEM +1.74%. Astoria believes EM will continue to struggle if the dollar strengthens and rates hold.

John Davi, CEO & Founder at Astoria Portfolio Advisors, will speak at EDGE Wealth Management. Join John along with 2000 participants and senior leaders now.