Satisfaction among self-driving investors remained static in an annual JD Power survey released today, showing that investors' happiness with their self-driving vehicles did not correlate well with a strong stock market.

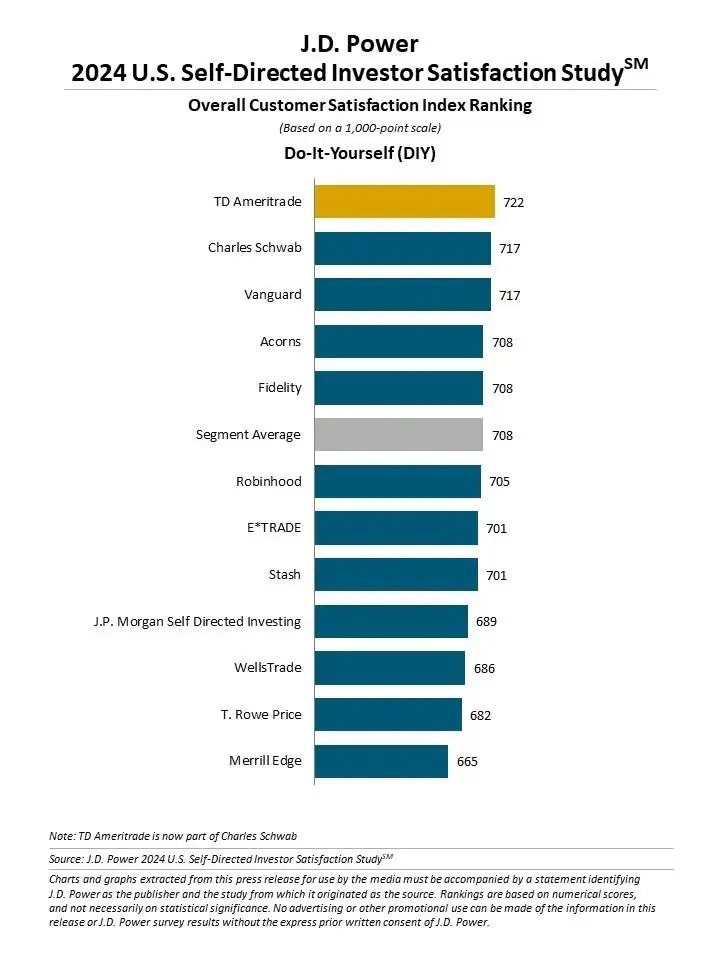

Overall satisfaction among do-it-yourself investors was at 708 on a 1,000-point scale in 2023, according to JD Power's 2024 US Do-It-Yourself Investor Satisfaction Study. Satisfaction was up a single point from 2023, but also by 2021. JD Power found that satisfaction was highest among active traders, while lowest among investors using a buy-and-hold strategy.

“Trust will be a key variable for brokerage firms as they struggle to attract the growing ranks of millennial and Gen Z do-it-yourself investors,” said JD Power Senior Director of Wealth Intelligence Kapil Vora. “Right now, trust levels are flat and until firms find ways to better connect with investors, they will struggle to create the incremental relationships they need to differentiate and add value beyond digital capabilities.”

JD Power's survey of self-directed investors is in its 22nd year. The 2024 survey includes responses between January 2023 and January 2024 from 9,875 investors who made all investment decisions “without the advice of a dedicated full-service financial advisor,” according to JD Power.

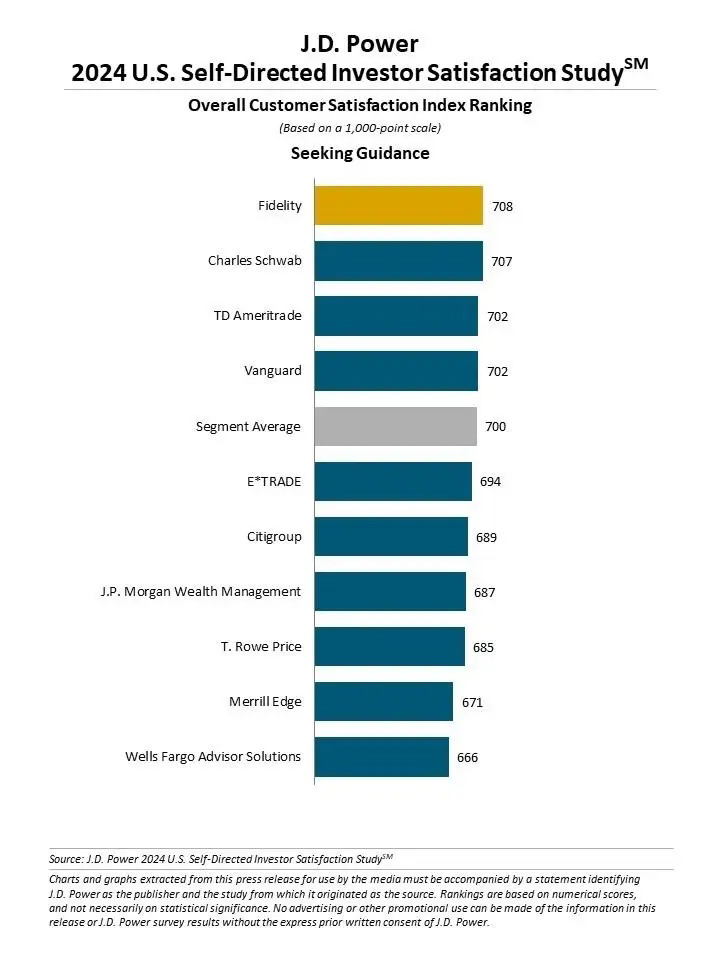

Fidelity received the highest marks among self-directed trading platforms, ranking highest for investors seeking guidance in making trading decisions with 708 points, with Charles Schwab right behind at 707. Vanguard and TD Ameritrade were third to a draw at 702 (although TD Ameritrade clients switched to Schwab in 2023).

For DIY investors, now-dormant TD Ameritrade took the top spot with 722, with Charles Schwab and Vanguard tied for second with 717.

Although DIY investor satisfaction stagnated year-over-year, satisfaction among self-directed investors seeking guidance from their apps of choice rose 15 points from 685 to 700 between 2023 and 2024 (overall satisfaction for this group was 692 to 21921 and 2022).

JD Power dichotomized respondents as DIY investors who can still contact their firms for information without seeking help from a licensed financial advisor or self-directed investors who “seek guidance” who can access a licensed financial professional. (often through a call center or centralized unit).

Craig Martin, an executive director and head of wealth and lending intelligence at JD Power, found the increased satisfaction from these self-directed dealers to be evident.

“The one area where we are seeing increased demand across all categories of investors – even those historically characterized as strictly DIY – is for some level of personalized guidance and support,” he said. “Right now, that guidance is missing from many firms.”