Years ago, retirement plan experts built their businesses targeting plans using blind puppies and squirrels, highlighting the risks while emphasizing the benefits of using a specialist. The same philosophy is driving changes for CPA plan auditors along with revised requirements and PEPs, which limit audit costs for their members.

And although fewer DC plans use inexperienced CPAs to audit their plan, according to a DOL Report 2023, “70 percent of audits fully complied with professional auditing standards or had only minor deficiencies according to professional standards.” The result, according to the DOL, is, “30 percent of the audits (3 out of 10) contained major deficiencies … (that) put $927 billion and 11.7 million plan participants and beneficiaries at risk.”

This compares to 39%, $653 billion and 22.5 million participants in their 2015 study. Not surprisingly, the DOL found a correlation between “the number of employee benefit plan audits performed by a CPA and the quality of the audit work.”

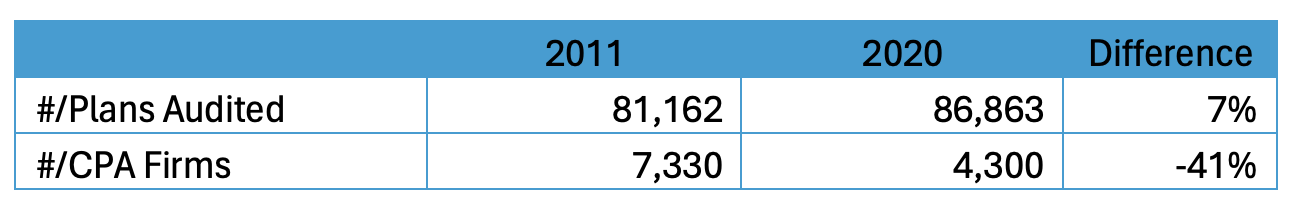

The DOL 2023 report showed a 7% increase in the number of plans audited from 2011-2020 and a 41% decrease in the number of CPA firms performing audits:

Changes to the DOL's definition of “larger” plans requiring an audit last year are expected to eliminate audit requirements for approximately 20,000 plans. The big change is that the number of 100 participants now includes only those who have a balance and are not eligible to participate. Additionally, if they were a “small plan” filer in the previous year, the plan can remain a small plan filer until the number of plan participants reaches 121. All of this makes exits that much more important. of strength now at $7,000 or less.

The number of plans may drop rapidly due to the new criteria of “large” plans and PEPs.

PEP providers lure plans that promise to greatly reduce or eliminate the cost of an audit since the bundled plan only has to submit one audit. But according to Karen Sanchez, Partner at Sikich, “Cost reduction depends on the composition of the PEP and how many samples need to be taken.”

Sanchez noted that the risks of using an inexperienced ERISA auditor include prolonged interaction with the DOL during an investigation, as well as the inability of the inexperienced auditor to detect problems early on. Although she does not build systems that integrate payroll and record keeping, a key component of an ideal successful plan, she can review processes and make suggestions as she does for running a plan in general.

Russ Kanner, Senior Manager at Smith + Howard, notes that the main issues he finds with plans include:

- Definition of compensation

- Timely delivery of adjournments

- Timely submission of plan audit with Form 5500

Brad Bartells, partner at MUN CPAs, said many plans do not follow plan documents specifically related to the definition of compensation. It's like having an IPS but not following the rules. Loan distribution can be another issue, according to Todd Hallowell, founder of 401(k) Assurance, as well as looking for things that aren't needed that could be red flags for the DOL.

All of which can make RPAs wonder, “Why should I care?”

Plans require their advisor to be their quarterback overseeing the entire plan and all vendors. If something goes wrong with the audit, plans won't be happy to hear their advisor say, “It's not my problem.” Maybe it's not their fault, but it's their problem.

It's also amusing to me when advisors use litigation as a scare tactic for smaller and mid-sized plans. The chances that plans under $100 million or even $250 million will be sued are low, and meritless copycat lawsuits are being thrown out faster. But DOL audits and investigations are much more likely, which is a form of litigation for smaller plans. Advisers who proactively suggest to the 11.7 million plans using a “blind squirrel” auditor that a change is required will be evaluated even if there is a risk of offending the client's CPA performing the audit. As they did when many of them were hired.

The American Institute of Certified Public Accountants (AICPA) Employee Benefit Plan Audit Quality Center lists almost 2,000 qualified CPAs on its website.

So while it's not sex, helping with audits and recommending qualified CPAs is an RPA that not only stands out, but also helps the plan avoid costly mistakes and identify problems before they metastasize. And helping clients avoid audits due to the DOL's new definition of “large” plans, as well as joining a PEP would further elevate the plan advisor.

Fred Barstein is the founder and CEO of TRAU, TPSU and 401kTV.