One of the most frequent questions I get is what to do when an investor has received a large amount of money (perhaps from an inheritance or the sale of a business). Should they invest it all at once or dollar cost average (DCA)? Fortunately, empirical research findings provide the optimal answer from a purely financial perspective.

Academic research, including the 1979 study A note on dollar suboptimality–Cost averaging as an investment policy, 1992 study Nobody Wins from Dollar Cost Averaging: Analytical, Numerical, and Empirical Results, and the 2011 study Does Dollar Cost Averaging Make Sense for Investors?, has found that investors tip the odds significantly in their favor by investing all assets at once – and when DCA outperforms (in the minority of cases), it tends to do so for much less than when it underperforms little (in most cases).

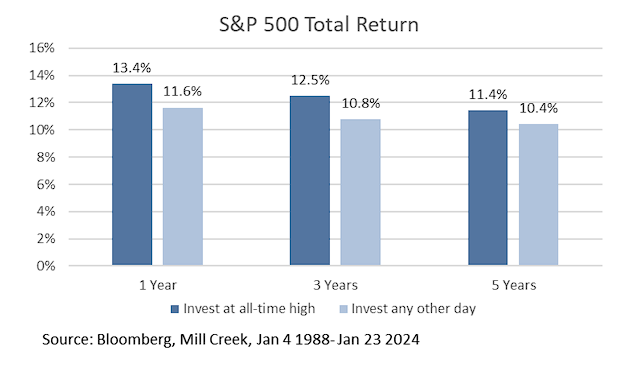

When I presented this evidence to an investor, I was asked, “While it's been averaging like this, the market just hit an all-time high, so maybe I should just wait for a market pullback?” Thanks to Michael Crook, chief investment officer at Mill Creek Capital Advisors, we can examine the empirical witness. Crook reviewed the returns of the S&P 500 Index over the one-, three-, and five-year periods following an all-time high and compared them to the returns if they had been purchased on any other day. His data sample covered January 4, 1988 through January 23, 2024. As shown in the table below, buying when the S&P 500 Index was at an all-time high outperformed buying on any other day during each period retention examined, with excess performance ranging from 1 percentage point to 1.8 percentage points.

Despite the empirical evidence, DCA remains a popular strategy among individual investors. The popularity of the strategy is likely to be explained, at least in part, by the lack of knowledge of the evidence we reviewed. Popularity is also shown by DCA being a risk averse strategy because those who use it hold cash until the plan is fully implemented. Additionally, behaviorists would explain that the popularity results from DCA investors seeking to minimize potential regret (loss aversion) for investing a large amount.

Investor Takeaway

Historical evidence makes it clear that DCA is an inferior investment strategy. That said, it can still serve a purpose: If you're so risk-averse that you wouldn't invest if you were forced to choose between investing a large sum or nothing at all, DCA becomes the 'least worst'.

Larry Swedroe is head of financial and economic research for Buckingham Wealth Partners, collectively Buckingham Strategic Wealth, LLC and Buckingham Strategic Partners, LLC.

For informational and educational purposes and should not be construed as specific investment, accounting, legal or tax advice. Some information is based on data from third parties and may become out of date or be replaced without notice. Third-party information is believed to be reliable, but its accuracy and completeness cannot be guaranteed. The opinions expressed herein are their own and may not accurately reflect those of Buckingham Strategic Wealth, LLC or Buckingham Strategic Partners, LLC, collectively Buckingham Wealth Partners. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article. LSR-23-617